« IRS Postpones New Rollover Rule to January 1, 2015 | Main | IRS Grants Temporary Relief to Sponsors of One-Person Plans Who Failed to File One or More 5500-EZ Forms, Including For a Terminated Plan »

Monday, April 14, 2014

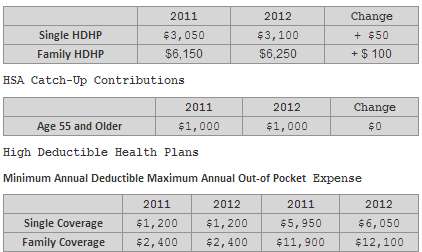

IRS Issues 2015 HSA Indexed Amounts

The Treasury Department and Internal Revenue Service issued new guidance on the maximum contribution levels for Health Savings Accounts (HSAs) and out-of-pocket spending and deductible limits for High Deductible Health Plans (HDHPs) that must be used in conjunction with HSAs. The HSA contribution limits for 2015 have increased by a small amount and a small percentage over the 2014 limits. The2015 limits are set forth in Revenue Procedure 2014-30. The catch-up contribution amount of $1,000 is not subject to being adjusted by the COLA adjustment of Code section 223(g) and so it remains at $1,000 for 2015. The minimum annual deductible limits and the maximum annual out-of-pocket expense limits for 2015 have also increased

The IRS normally announces these changes in May each year so that employers and individuals will have sufficient time to plan for HDHP insurance coverage and HSA contributions for 2015 and so that insurance companies may revise their HDHP policies. This year the IRS announced the new limits on April 25.

CWF will be updating our HSA brochures and our HSA Amendments immediately so they could be furnished with the mailing of 5498-SA forms.