« Self-Directed IRAs | Main | Traditional IRAs »

Monday, October 31, 2016

IRA Contribution Limits for 2017 – Unchanged at $5,500 and $6,500; 401(k) Limits Unchanged Also

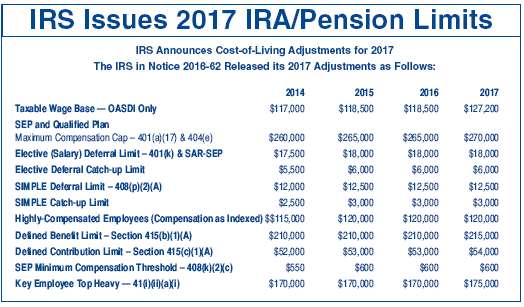

Inflation was approximately .3% for the fiscal quarter ending September 30, 2016, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.

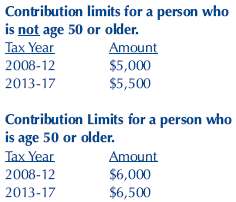

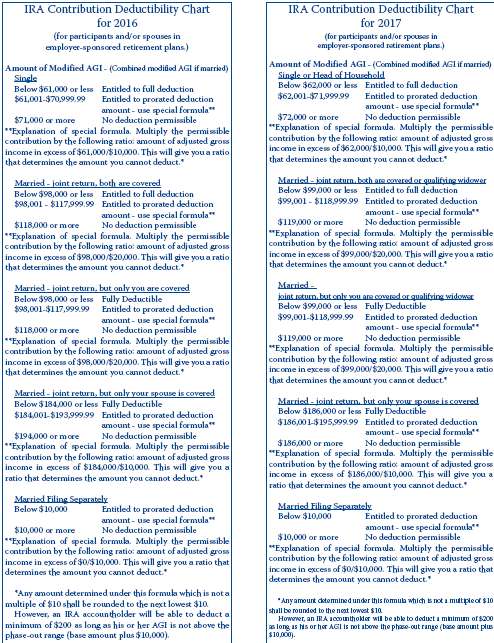

The maximum IRA contribution limits for 2017 for traditional and Roth IRAs did not change – $5,500/$6,500.

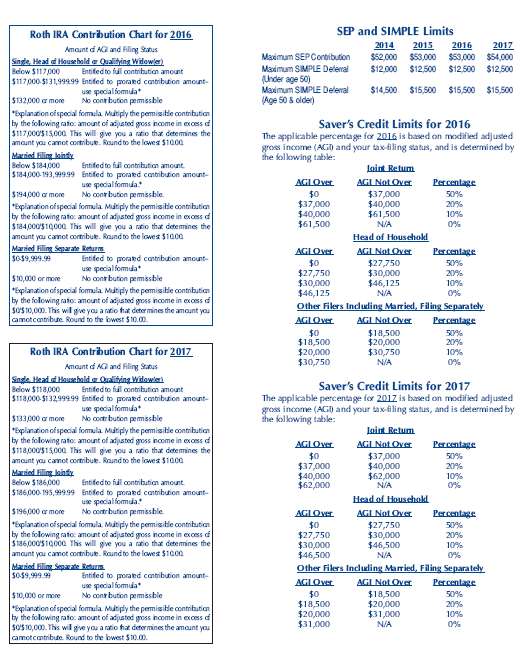

The 2017 maximum contribution limit for SEP-IRAs is increased to $54,000 (or,25% of compensation, if lesser) up from $53,000. The minimum SEP contribution limit used to determine if an employer must make a contribution for a part-time employee remains the same at $600.

The 2017 maximum contribution limits for SIMPLE-IRAs is unchanged at $12,500 if the individual is under age 50 and$15,500 if age 50 or older.

The 2017 maximum elective deferral limit for 401(k) participants is unchanged at $18,000 for participants under age 50 and $24,000 for participants age 50 and older.

Edited on: Tuesday, November 08, 2016 14:21.07

Categories: Pension Alerts, Roth IRAs, SIMPLE IRAs, Traditional IRAs

Wednesday, August 19, 2015

SIMPLE-IRA Summary Description — IRA Custodian Must Furnish by October 2015 for 2016

What are a financial institution’s duties if it is the custodian or trustee of SIMPLE IRA funds? After a SIMPLE IRA has been established at an institution, it is the institution’s duty to provide a Summary Description each year within a reasonable period of time before the employees’ 60-day election period. CWF believes that providing the Summary Description 30 days prior to the election period would be considered “reasonable.” The actual IRS wording is that the Summary Description must be provided “early enough so that the employer can meet its notice obligation.” You will want to furnish the Summary Description to the employer in September or the first week of October. The employer is required to furnish the summary description before the employees’ 60-day election period.

IRS Notice 98-4 provides the rules and procedures for SIMPLEs.

The Summary Description to be furnished by the SIMPLE IRA custodian/trustee to the sponsoring employer depends upon what form the employer used to establish the SIMPLE IRA plan.

The employer may complete either Form 5305-SIMPLE ( where all employees’ SIMPLE IRAs are established at the same employer-designated financial institution ) or Form 5304-SIMPLE ( where the employer allows the employees to establish the SIMPLE IRA at the financial institution of their choice ).

There will be one Summary Description if the employer has used the 5305-SIMPLE form. There will be another Summary Description if the employer has used the 5304-SIMPLE form. If you are a user of CWF forms, these forms will be Form 918-A and 918- B.

The general rule is that the SIMPLE IRA custodian/trustee is required to furnish the summary description to the employer. This Summary Description will only be partially completed. The employer will be required to complete it and then furnish it to his employees. The employer needs to indicate for the upcoming 2016 year the rate of its matching contribution or that it will be making the non-elective contribution equal to 2% of compensation.

In the situation where the employer has completed the Form 5304-SIMPLE, the IRS understands that many times the SIMPLE IRA custodian/trustee will have a minimal relationship with the employer. It may well be that only one employee of the employer establishes a SIMPLE IRA with a financial institution. In this situation, the IRS allows the financial institution to comply with the Summary Description rules by using an alternative method. To comply with the alternative method, the SIMPLE IRA custodian/trustee is to furnish the individual SIMPLE IRA accountholder the following:

- A current 5304-SIMPLE — this could be filled out by the employer, or it could be the blank form

- Instructions for the 5304-SIMPL

- Information for completing Article VI ( Procedures for withdrawal ) (You will need to provide a memo explaining these procedures. )

- The financial institution’s name and address. Obviously, if an institution provides the employee with a blank form, he/she will need to have the employer complete it, and, the employee may well need to remind the employer that it needs to provide t he form to all eligible employees.

CWF has created a form that covers the “alternative” approach of the Summary Description being provided directly to an employee.

The penalty for not furnishing the Summary Description is $50 per day.

Special Rule for a “transfer” SIMPLE IRA.

There is also what is termed a “transfer” SIMPLE IRA. If your institution has accepted a transfer SIMPLE IRA, and there have been no current employer contributions, then there is no duty to furnish the Summary Description. If there is the expectation that future contributions will be made to this transfer SIMPLE IRA, then the institution will have the duty to furnish the Summary Description.

Reminder of Additional Reporting Requirements

The custodian/trustee must provide each SIMPLE IRA account holder with a statement by January 31, 2016, showing the account balance as of December 31, 2015 , (this contribution and distribution is the same as for the traditional IRA ), and include the activity in the account during the calendar year ( this is not required for a traditional IRA ). There is a $50 per day fine for failure to furnish this statement ( with a traditional IRA, it would be a flat $50 fee )