« Financial Institution Must Notify DOL It Will Use BICE And Must Comply With Record Keeping Requirements | Main | New IRS Procedures For Reporting Late Rollover Contributions »

Monday, October 31, 2016

IRA Contribution Limits for 2017 – Unchanged at $5,500 and $6,500; 401(k) Limits Unchanged Also

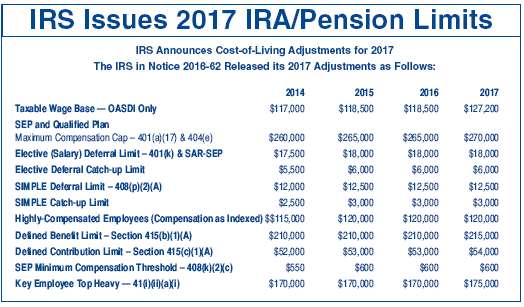

Inflation was approximately .3% for the fiscal quarter ending September 30, 2016, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.

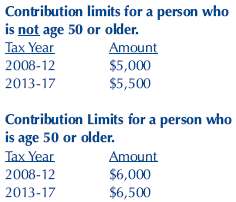

The maximum IRA contribution limits for 2017 for traditional and Roth IRAs did not change – $5,500/$6,500.

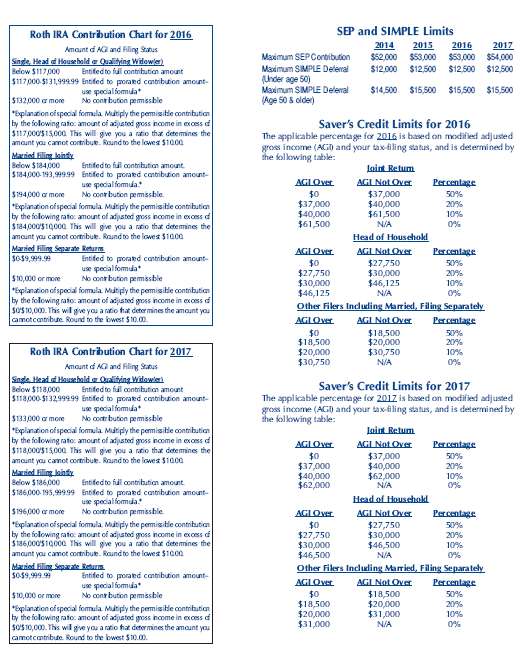

The 2017 maximum contribution limit for SEP-IRAs is increased to $54,000 (or,25% of compensation, if lesser) up from $53,000. The minimum SEP contribution limit used to determine if an employer must make a contribution for a part-time employee remains the same at $600.

The 2017 maximum contribution limits for SIMPLE-IRAs is unchanged at $12,500 if the individual is under age 50 and$15,500 if age 50 or older.

The 2017 maximum elective deferral limit for 401(k) participants is unchanged at $18,000 for participants under age 50 and $24,000 for participants age 50 and older.

Edited on: Tuesday, November 08, 2016 14:21.07

Categories: Pension Alerts, Roth IRAs, SIMPLE IRAs, Traditional IRAs