« Understanding What Forms Are Needed To Establish a SEP-IRA | Main | IRS Increases Filing Fees For Waiver of 60-Day Rollover Rule To $10,000 »

Tuesday, January 26, 2016

New SIMPLE-IRA Rollover and Transfer Rules

The tax laws for rolling over or transferring funds into a SIMPLE-IRA changed as of December 18, 2015. A person who is a SIMPLE-IRA participant, whose employer first made a SIMPLE-IRA contribution more than 2 years ago and who is eligible for a 401(k) distribution is now authorized to take a distribution from the 401(k) plan and directly rollover or rollover such funds into the SIMPLE-IRA.

The tax rules now also authorize an individual to take a distribution from his or her traditional IRA or SEP-IRA and to transfer or rollover such funds into his or her SIMPLE-IRA. The individual must have met the 2 year rule applying to the SIMPLE-IRA plan. Presently you may have some customers who have both a traditional IRA and a SIMPLE-IRA because the tax laws required this prior to December 18, 2015. No longer, if the individual has met the two year rule, then the traditional IRA funds may be merged into the SIMPLE-IRA.

This law change means an IRA custodian should be using updated rollover, transfer, and SIMPLE-IRA plan agreement forms. SIMPLE-IRA amendments should be furnished. We expect (and hope) the IRS will soon be revising its model SIMPLE-IRA Forms (5305-S and 5305-SA) as these forms expressly provide that it is impermissible to contribute funds to a SIMPLE-IRA arising from a traditional IRA or a 401(k) plan. Until then, an amendment should be added to such forms authorizing such rollover, direct rollover and transfer contributions.

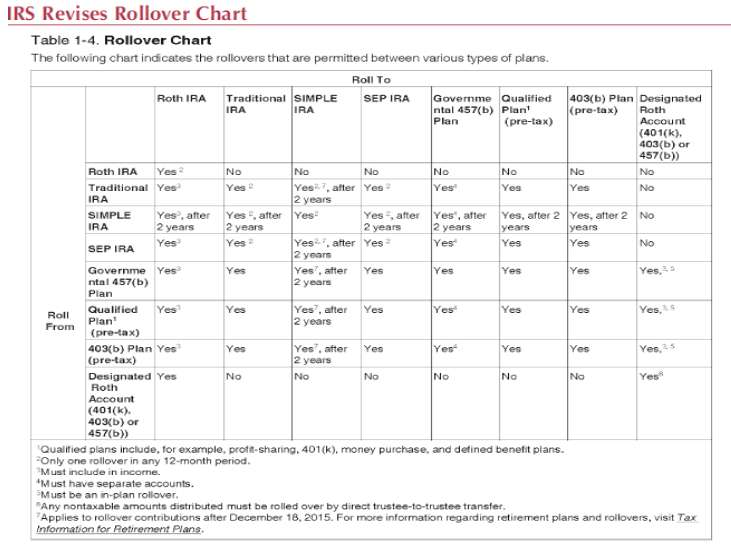

The IRS has revised its IRA Rollover Chart showing the new rollovers applying to SIMPLE-IRAs.

.

New SIMPLE-IRA Rollover and Transfer Rules

Roth IRA funds are only eligible to be rolled over to another Roth IRA. They are ineligible to be rolled over to any other type of IRA or any qualified plan, 403(b) plan or governmental 457(b) plan, including a Designated Roth account.

- The once per year rollover rule applies when there is a distribution from a traditional IRA, SEP-IRA, SIMPLE-IRA or Roth IRA distribution which is rolled over to a traditional, SEP IRA, SIMPLE-IRA or Roth IRA. It does not apply to distributions from any non-IRA plan. It does not apply to distributions from a traditional IRA, SEP IRA or SIMPLE-IRA which is rolled over to a qualified plan, 403(b) plan or governmental 457(b) plan

- Funds within any non-SIMPLE-IRA or any plan are now eligible to be rolled over into a SIMPLE-IRA if the 2-year requirement has been met

- SIMPLE-IRA funds may be distributed and rolled over into any other type of plan only if such rollover occurs after the 2-year holding requirement has been satisfied.

- Funds within any of the 4 types of IRAs are ineligible to be rolled over in a Designated Roth account within a 401 (k) , 403 (b) or 457 (b) plan.

- Funds within a qualified plan, 403(b) plan or governmental 457 plan may be rolled into a Designated Roth account within a 401(k), 403b) or section 457b only if done as an in-plan rollover. Such distribution amount is includible in income.

-

Designated Roth funds may be distributed and rolled over into a Roth

IRA or they may be transferred into a Designated Roth account within a

different plan. That is, Designated Roth funds cannot be withdrawn and

then rolled over by the participant. Observe that there are some

special rollovers not discussed by the IRS chart.

a. IRA to HSA direct rollovers

b. Direct rollovers by both spouse beneficiaries and non-spouse beneficiaries.