« March 2016 | Main | January 2016 »

Tuesday, February 16, 2016

IRS Increases Filing Fees For Waiver of 60-Day Rollover Rule To $10,000

The IRS has increased the filing fee for a person to request the IRS to waive the 60-day rollover period and grant the person a new 60-day rollover period. Since 2001/2002 the tax law has provided that the IRS may waive the 60-day requirement where the failure to waive such requirement would be against equity or good conscience, including casualty, disaster, or other events beyond the reasonable control of the individual.

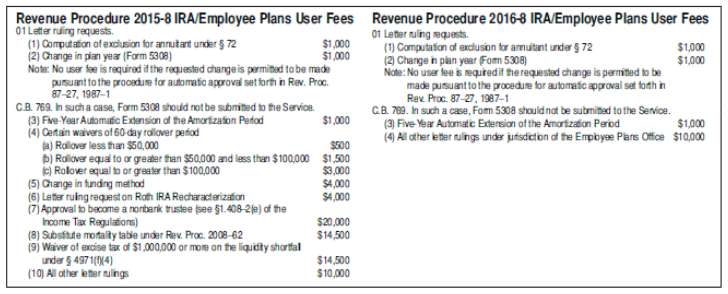

The chart below compares the fees for 2015 with those for 2016. Category number #4 for 2016 encompasses the 2015 categories #4-#10 for 2015. The filing fee is $10,000 for any one in category #4.

In 2015 the filing fee to request a 60 rollover waiver was $500, $1,500 or $3,000. If it is now $10,000, there will be very few taxpayers where it will make financial sense to seek a waiver. An individual who has a good reason they missed the 60-day period will need to consider hiring a tax attorney to sue the IRS in U.S. Tax Court. This IRS change is going to create real dilemmas for IRA custodians as much more work will be involved in getting the IRS to waive the initial 60-day period.

One would think it was near impossible that the IRS would increase the filing fees with respect to a person’s request of the IRS to waive the 60-day rollover rule to $10,000 form $500, $1,500 or $3000 for an equity waiver situation, but the IRS is warring with the Republican controlled Congress and the new $10,000 filing fee is correct. The IRS has adopted this policy to spite the U.S. Congress.

Note that the IRS chart contains good news for those non-bank financial entities wishing to qualify as a non-bank trustee. The fee decreases from $20,000 to $10,000.

Also note the fee for requesting special treatment on a missed Roth IRA recharacterization increases from $4,000 to $10,000.