« July 2013 | Main | January 2013 »

Wednesday, May 15, 2013

IRA Limits for 2013

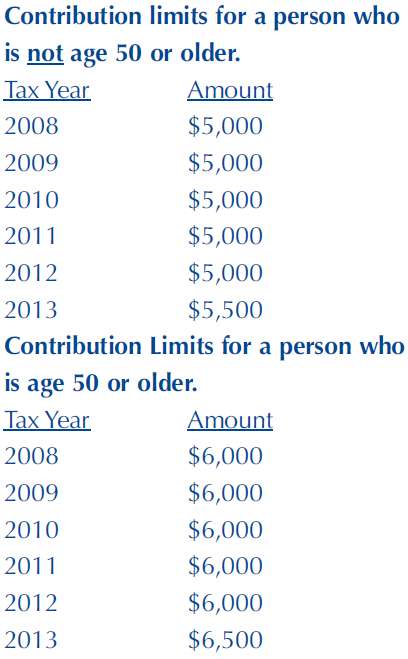

After many years, the maximum IRA contribution limits for 2013 will be $500 larger. For 2008-2012, if a person was not age 50 as of December 31, then his or her maximum contribution was $5,000 assuming he or she had compensation of at least $5,000. This limit increases to $5,500 for 2013. For 2008-2012, if a person was age 50 or older as of December 31, then his or her maximum contribution was $6,000. This limit increases to $6,500 for 2013. The annual catch-up contribution limit for individuals age 50 or older remains at $1,000. Hopefully, contributions for 2013 will be larger than those for 2012 and end the recent decrease in IRA contributions.

Edited on: Monday, April 14, 2014 15:42.28

Categories: Pension Alerts, Traditional IRAs

Tuesday, May 14, 2013

Military Death Gratuity and Service-members Group Life Insurance Payment and Roth IRAs.

A special type of rollover contribution is authorized. If a person receives a military death gratuity or a payment from Servicemembers’ Group Life Insurance (SGLI), this person may roll over all or part of the amount received to his or her Roth IRA. Such payments are made to an eligible survivor upon the death of a member of the armed forces.

If you are the person and you are a member of the decedent’s family, then you may make a rollover contribution to your Roth IRA. The maximum amount eligible to be rolled over is the total of the survivor benefits less any amounts already rolled over on your behalf of another family member’s behalf to a Roth IRA or other Coverdell ESAs. The amount of survivor benefits contributed to the Roth IRA will be basis and will not be taxed when withdrawn.

This special rollover must be completed within one year after the date the individual received the death benefit gratuity or the SGLI payment. The once per year rollover limit applying during a 12-month period does not apply to rolling over a military death gratuity or a SGLI payment.

This special rollover is not subject to the annual contribution limits applying to Roth IRA contributions.

Edited on: Monday, April 14, 2014 15:42.58

Categories: Pension Alerts, Roth IRAs, Traditional IRAs

IRA Amendment Being Required

The IRS last revised the model IRA Forms 5305, 5305- A, 5305-R and 5305-RA in March of 2002. Since then there have been numerous tax laws enacted with IRA changes. The IRS has given no written explanation as to why the IRA forms have not been amended. We have asked a number of times when the IRS would be revising their IRA forms, but to no avail. It is not a good thing that the IRS has not updated their forms.

When is it necessary for an IRA custodian/trustee to furnish an IRA amendment? Is it necessary or required to furnish one in 2013?

Each institution must make its own determination because one needs to understand when was the IRA agreement last amended and how is it being amended. A primary question is, “when is the last time the financial institution furnished an amendment?” What do the current IRA plan agreements provide? Are there some IRAs set up with one certain plan agreement and others with a different plan agreement?

One may learn a tax lesson the hard way, if he or she adopts the position that an amendment is not required because the IRS has not said one is required. One must remember that the IRS has already stated in its governing IRA regulation(1.408- 6 (d) (4) (ii) (C) ) when an IRA amendment is required. The regulation must be followed until the IRS revises it.

There are two types of amendments – one which amends the IRA plan agreement and one which amends the IRA disclosure statement. Regulation 1.408- 6(4)(ii)(C) requires that an IRA amendment be furnished no later than the 30th day after the amendment is adopted or becomes effective.

The general rule in the governing IRA regulation is - a law change is enacted which impacts a provision found in the IRA plan agreement; the provision will be amended to implement the law change and the amendment will need to be communicated to the IRA accountholder or inheriting beneficiary.

When the IRS revises its model IRA forms, the amendment is considered to be mandatory or required. When a non-IRS change is made in the plan agreement by the financial institution (or the IRA vendor), the change may either be mandatory or not.

Mandatory changes deal with the tax code changes. For example, CWF has amended the Roth IRA plan agreement so that any person with funds in a traditional IRA is eligible to convert some or all of these funds to a traditional IRA even though he or she may have MAGI of more than $100,000.

The IRS has not yet amended its model Roth IRAs (Forms 5305-R and 5305-RA) to remove the $100,000 restriction. And the IRS has not given any guidance as to whether or not a conversion done in 2010 or later qualifies or doesn’t qualify since Form 5305-R and 5305-RA state that the custodian/ trustee may not accept a conversion contribution if the person has a MAGI greater than the $100,000.

The standard IRS rule for IRAs/pensions has always been - the plan document must authorize the action. For this reason, even though the IRS has not amended the Roth forms, CWF has. And CWF has added provisions authorizing new rollovers from 401(k) plans and other employer plans. And CWF has made other changes or amendments to adopt law changes. Other vendors have taken the approach, we don’t need to amend our form because the IRS has not done so. Similar changes have been made by CWF in the traditional plan agreement forms.

Non-mandatory amendments would be made by a financial institutions for its own administrative reasons. If an institution would want such a change or changes to apply to all existing IRA accountholders or some of them, the amendment would be furnished to those accountholders which the financial institution wanted the new provision to apply. An example, in 2011/2012 CWF added special provisions covering the topics of when a power of attorney is designated by the IRA accountholder, when a non-IRS creditor may impose a claim against an IRA, or when a trust beneficiary or an estate beneficiary will have special pass-through requests.

A long time ago (1986/1987) the IRS acknowledged that there are times that even though the IRA plan agreement has not been changed, a disclosure statement amendment must still be furnished. Example, when the deductible/nondeductible rules were first authorized in 1986/1987, such rules did not require the IRA form to be rewritten because the IRA form discusses the maximum contribution amount limit, but does not discuss the deductible/nondeductible rules. The IRS stated there needed to be a disclosure statement amendment discussing or explaining the deductible/nondeductible rules.

In summary, answering a question whether or or not an amendment is required is not all that simple. Sometimes the caller will furnish some additional information, but many times not. Each financial institution will need to make its own decision if there is a requirement to furnish one or both amendments or if it will furnish the amendments so there is no question.

It is true that the IRS has not been very active in auditing whether or not IRA custodian/trustees are furnishing IRA amendments as required by the IRA regulation. We at CWF believe it is in the best interest of a financial institution to furnish the amendments. The governing IRA regulation provides that a $50 fine may be assessed an institution for each time it fails to furnish the IRA plan agreement and $50 each time it fails to furnish the IRA disclosure amendment.

Edited on: Monday, April 14, 2014 15:43.22

Categories: Amendments, Pension Alerts

IRS Gives Guidance on Qualified Charitable IRA Distributions for 2012 and 2013

During the first week of January we sent subscribers an email explaining that the American Taxpayer Relief Act of 2012 (ATRA) as signed into law by President Obama on January 2, 2013, extended the QCD (qualified charitable distributions) provisions for 2012 and 2013. These provisions will not apply for 2014 and subsequent years unless there would be another tax extension.

The IRS has recently issued guidance to IRA accountholders and also IRA custodians regarding QCDs for 2012 and 2013. A qualified charitable distribution (QCD) is an otherwise taxable distribution from a traditional IRA, Roth IRA, or a SEP IRA or SIMPLE-IRA to which a current year contribution has not been made, to an IRA accountholder or an inheriting IRA beneficiary who is age 70½ or older that is paid directly to a qualified charity. A QCD for a year can be used to satisfy the RMD for such year. A qualifying individual who makes a QCD may exclude from his or her gross income up to $100,000 for a year.

ATRA included two special transition rules to handle the situation that until ARTA was adopted retroactively an IRA accountholder was unable to make a QCD for 2012. Consequently, ATRA was written to include two special transition rules which allow an IRA accountholder or an inheriting beneficiary to make a QCD for 2012 in January of 2013.

Transition rule #1. An IRA accountholder who had taken a distribution which did not qualify as a QCD in December of 2012 could in January give cash to the charity of all or a portion of such IRA distribution and have it now qualify to be a QCD for 2012 provided that such contribution would have been a 2012 QCD if it had been paid directly to the charity from the IRA. Note that distributions made directly to the IRA accountholder from January 1, 2012 to November 30, 2012 will not qualify as a QCD for 2012. As discussed in prior newsletters, if the distribution had been made directly to the charity under the QCD rules, the distribution will qualify as a QCD if all of the other requirements had also been met.

Transition rule #2. By January 31, 2013, the IRA custodian pursuant to the instruction from the IRA accountholder that he or she still wants to make a QCD for 2012 pays the charity directly a 2013 distribution. It will qualify to be a QCD for 2012 provided that such contribution would have been a 2012 QCD if it had been paid in 2012.

A QCD made in January of 2013 that is treated as a 2012 QCD will satisfy an individual’s RMD for 2012, This is true even if the individual would have otherwise owed the 50% tax for failing to take his or her RMD by December 31, 2012. The IRS has stated that a QCD made in January of 2013 must be for 2012 and cannot be designated 2013. This is true even if the individual had already satisfied his RMD for 2012. 2012 and 2013 Reporting Duties of the Individual

The individual is to report the total 2012 QCDs made in January 2013 on their 2012 Form 1040 by including the full amount of the 2012 QCDs (even if in excess of $100,000) on line 15a and not including any amount on line 15b (i.e. leave it blank), but “QCD” must be written next to line 15b. For years 2006-2011, line 15b had been completed with 0 if the QCD was the same as the total distributions.

The individual will also report on the 2013 Form 1040 the amount of 2012 QCDs made in January 2013. The specifics as to how such reporting is to be made on the 2013 Form 1040 as will be discussed in the instructions for the 2013 Form 1040.

An IRA accountholder or an inherited IRA beneficiary who makes a QCD for 2012 in January of 2013 must keep the appropriate tax records to substantiate the timing of the distribution from the IRA and the contribution to the charity.

If a 2012 Form 8606 must be filed, the instructions to the form will describe how to report any 2012 QCD made in January of 2013. An IRA accountholder must file a 2012 Form 8606, nondeductible IRAs, with his or her 2012 Form 1040 if: the 2012 QCD was from a traditional IRA and there was basis and there had been a distribution in 2012 other than the 2012 QCD or the 2012 QCD was from a Roth IRA.

2012 and 2013 Reporting Duties of the IRA Custodian and RMD Calculation for 2013.

ATRA states that the QCD made in January of 2013 for 2012 is treated as if if had been made on December 31. Because of this, the IRS has stated that in determining the RMD for 2013, the 2012 QCD made in 2013 must be subtracted from the fair market value as of December 31, 2012. Where appropriate an IRA custodian will need to send a revised RMD notice.

The IRA custodian will report any distribution occurring in 2012 on the 2012 Form 1099-R. As for years 2006-2011, these distributions are reported as taxable even if they were QCDs.

Distributions made in 2013, including any 2012 QCDs made in January of 2013 are reported on the 2013 Form 1099-R in the same manner. Boxes 1 and 2a will be completed with the same amount and the individual must complete line 15b to show as non-taxable.

2013 QCD Rules and Procedures

The standard rules and procedures will apply in 2013 for 2013 QCDs made after January 31. The check from the IRA custodian or trustee will need to be issued to the charity and the check must have a date of December 31, 2013, or earlier.

Any bets if it will be extended for 2014 and 2015?

Edited on: Monday, April 14, 2014 15:43.44

Categories: Pension Alerts, Traditional IRAs

ATRA Makes Permanent the Coverdell ESA Law Changes Made in 2001

Unlike with the QCD which has had another 2 year short term extension, the Coverdell ESA changes of 2001 have been adopted on a permanent basis. The main changes are: the maximum contribution limits remains at $2,000 and is not reduced to $500, qualifying education expenses are all school related education expenses and not just post-secondary expenses and the special rules applying to an individual who has special needs.

The IRS should be revising its model Coverdell ESA forms (Form 5305-E and 5305-EA) to incorporate the special laws applying to individuals with special needs and the law authorizing military death gratuities be rolled over into a Coverdell ESA. Certain family members of soldiers who receive military death death benefits may make a rollover contribution, subject to certain limits, up to 100% of such benefits into a Coverdell ESA.

CESAs For Special Needs Individuals

2013 Tax/Financial Planning Rule. There should be a Coverdell ESA established for every special needs individual. How many CESAs does your institution service for special needs individuals?

ARTA was enacted into law on January 2, 2013. The CESA law changes in effect from 2002-2011 were made permanent.

The special rules for individuals with special needs are now permanent. A $2,000 annual contribution may be made for an individual with special needs regardless of his or her age. That is, even if he person with special needs is age 39, an annual $2,000 contribution may be made to his or her CESA. As long as the earnings of the CESA are used for the special needs individual's educational needs, such income will not be taxable.

One would expect that many parents, grandparents, sisters, and brothers will choose to establish a Coverdell ESA for an individual with special needs. This assumes they understand the availability of the Coverdell ESA. For whatever reason, the IRS has not yet revised its model CESA forms to authorize and emphasize the special rules for individuals with special needs. Even though the IRS is busy implementing other taxes, the IRS hopefully will make this revision. We at CWF will be revising Coverdell ESA forms to discuss the special rules applying to individuals with special needs.

In many cases the fact that the only tax benefit is relatively nominal (no taxation of the earnings); in some cases, this no taxation of earnings will be a substantial tax benefit. Considering how easy it is to establish a Coverdell ESA, more people should be doing so.

Edited on: Monday, April 14, 2014 15:44.10

Categories: Coverdell ESAs, Pension Alerts

After many years, the maximum IRA contribution limits for 2013 will be $500 larger. For 2008-2012, if a person was not age 50 as of December 31, then his or her maximum contribution was $5,000 assuming he or she had compensation of at least $5,000. This limit increases to $5,500 for 2013. For 2008-2012, if a person was age 50 or older as of December 31, then his or her maximum contribution was $6,000. This limit increases to $6,500 for 2013. The annual catch-up contribution limit for individuals age 50 or older remains at $1,000. Hopefully, contributions for 2013 will be larger than those for 2012 and end the recent decrease in IRA contributions.

During the first week of January we sent subscribers an email explaining that the American Taxpayer Relief Act of 2012 (ATRA) as signed into law by President Obama on January 2, 2013, extended the QCD (qualified charitable distributions) provisions for 2012 and 2013. These provisions will not apply for 2014 and subsequent years unless there would be another tax extension.

The IRS has recently issued guidance to IRA accountholders and also IRA custodians regarding QCDs for 2012 and 2013. A qualified charitable distribution (QCD) is an otherwise taxable distribution from a traditional IRA, Roth IRA, or a SEP IRA or SIMPLE-IRA to which a current year contribution has not been made, to an IRA accountholder or an inheriting IRA beneficiary who is age 70½ or older that is paid directly to a qualified charity. A QCD for a year can be used to satisfy the RMD for such year. A qualifying individual who makes a QCD may exclude from his or her gross income up to $100,000 for a year.

ATRA included two special transition rules to handle the situation that until ARTA was adopted retroactively an IRA accountholder was unable to make a QCD for 2012. Consequently, ATRA was written to include two special transition rules which allow an IRA accountholder or an inheriting beneficiary to make a QCD for 2012 in

January of 2013.

Transition rule #1. An IRA accountholder who had taken a distribution which did not qualify as a QCD in December of 2012 could in January give cash to the charity of all or a portion of such IRA distribution and have it now qualify to be a QCD for 2012 provided that such contribution would have been a 2012 QCD if it had been paid directly to the charity from the IRA. Note that distributions made directly to the IRA accountholder from January 1, 2012 to November 30, 2012 will not qualify as a QCD for 2012. As discussed in prior newsletters, if the distribution had been made directly to the charity under the QCD rules, the distribution will qualify as a QCD if all of the other requirements had also been met.

Transition rule #2. By January 31, 2013, the IRA custodian pursuant to the instruction from the IRA accountholder that he or she still wants to make a QCD for 2012 pays the charity directly a 2013 distribution. It will qualify to be a QCD for 2012 provided that such contribution would have been a 2012 QCD if it had been paid in 2012.

A QCD made in January of 2013 that is treated as a 2012 QCD will satisfy an individual’s RMD for 2012, This is true even if the individual would have otherwise owed the 50% tax for failing to take his or her RMD by December 31, 2012. The IRS has stated that a QCD made in January of 2013 must be for 2012 and cannot be designated 2013. This is true even if the individual had already satisfied his RMD for 2012. 2012 and 2013 Reporting Duties of the Individual

The individual is to report the total 2012 QCDs made in January 2013 on their 2012 Form 1040 by including the full amount of the 2012 QCDs (even if in excess of $100,000) on line 15a and not including any amount on line 15b (i.e. leave it blank), but “QCD” must be written next to line 15b. For years 2006-2011, line 15b had been completed with 0 if the QCD was the same as the total distributions.

The individual will also report on the 2013 Form 1040 the amount of 2012 QCDs made in January 2013. The specifics as to how such reporting is to be made on the 2013 Form 1040 as will be discussed in the instructions for the 2013 Form 1040.

An IRA accountholder or an inherited IRA beneficiary who makes a QCD for 2012 in January of 2013 must keep the appropriate tax records to substantiate the timing of the distribution from the IRA and the contribution to the charity.

If a 2012 Form 8606 must be filed, the instructions to the form will describe how to report any 2012 QCD made in January of 2013. An IRA accountholder must file a 2012 Form 8606, nondeductible IRAs, with his or her 2012 Form 1040 if: the 2012 QCD was from a traditional IRA and there was basis and there had been a distribution in 2012 other than the 2012 QCD or the 2012 QCD was from a Roth IRA.

2012 and 2013 Reporting Duties of the IRA Custodian and RMD Calculation for 2013.

ATRA states that the QCD made in January of 2013 for 2012 is treated as if if had been made on December 31. Because of this, the IRS has stated that in determining the RMD for 2013, the 2012 QCD made in 2013 must be subtracted from the fair market value as of December 31, 2012. Where appropriate an IRA custodian will need to send a revised RMD notice.

The IRA custodian will report any distribution occurring in 2012 on the 2012 Form 1099-R. As for years 2006-2011, these distributions are reported as taxable even if they were QCDs.

Distributions made in 2013, including any 2012 QCDs made in January of 2013 are reported on the 2013 Form 1099-R in the same manner. Boxes 1 and 2a will be completed with the same amount and the individual must complete line 15b to show as non-taxable.

2013 QCD Rules and Procedures

The standard rules and procedures will apply in 2013 for 2013 QCDs made after January 31. The check from the IRA custodian or trustee will need to be issued to the charity and the check must have a date of December 31, 2013, or earlier.

Any bets if it will be extended for 2014 and 2015?

Edited on: Monday, April 14, 2014 15:44.26

Categories: Pension Alerts, Traditional IRAs