« Governmental Reporting | Main | Pension Alerts »

Tuesday, March 22, 2022

Email Consulting Guidance – HSA Transfer Mistakes or Difficulties

Email Consulting Guidance – HSA Transfer Mistakes or Difficulties

Posted by James M. Carlson

February 2022

Q-1. I have two HSA customers that we opened their HSA accounts in July of 2021 with a HSA transfer check from their prior HSA custodian BASC. This was coded as a transfer and they have had access to this money since July 2021. Both customers said that this now zeroed out their HSA accounts with BASC.

On Tuesday, I received two checks from BASC. The checks are made out to First State Bank and then the customer’s name. The transfer paperwork that was signed at the end of June 2021 to transfer this money was included with both checks. Clearly they have made an error and paid these accounts out twice. I have called BASC twice and have gotten nowhere as they say they cannot release any information to me. The one customer has, also, called them twice and has been told both times that we (First State Bank) need to deposit these checks in their HSA accounts and code them as a transfer or they will be taxed. BASC indicated to her that they made an error and this transfer never occurred in July 2021. Obviously that is not true as we have had the money since July 2021.

What would you suggest I do? Should I deposit these checks, code them as a transfer and wait until they discover their error? Should I send the checks back? I do have a copy of the checks they sent in July that opened these accounts as proof that we did receive this money. I’m just not quite sure how to proceed in the best way for both of them.

A-1. A transfer requires the consent of both HSA custodians. There is no requirement that FSB endorse the checks.

Was a transfer form furnished - twice, once or not all?

You could return them and explain why in writing. BASC has no right to adopt the position that if FSB fails to sign the checks that the individuals will be treated as having received a taxable distribution.

What do your customers want done?

If the customers believe they are entitled to these funds I believe you could process these transactions as a transfer. FSB could adopt the approach - the customer must assume full responsibility for these transfers and if he or she later comes to FSB and informs you that these contributions must be treated as an excess contribution and that then they agree to pay a ??? fee ($50.00) for all the work related to correcting the excess.

The more conservative approach is - return the checks unsigned.

Edited on: Tuesday, March 22, 2022 13:57.25

Categories: Health Savings Accounts

Wednesday, May 25, 2016

Inheriting HSA Beneficiary - Duty to Prepare Form 8889

If the HSA owner's surviving spouse is the designated beneficiary, the surviving spouse becomes the HSA owner. Consequently, he or she completes Form 8889 for transactions occurring after the HSA owner's death.

If the HSA owner has designated a non-spouse beneficiary and dies, the HSA ceases being an HSA. If the inheriting beneficiary is not the HSA owner's estate, the beneficiary completes Form 8889 as follows.

- Across the top of the form write, “Death of HSA Owner.

- At the top the beneficiary will insert his/her name and social security number. Part I (Contributions) is not to be completed. It is to be skipped as no additional HSA contributions may be made by a beneficiary

- On line 14a the HSA’s fair market value as of the date of death is inserted. The beneficiary includes this amount in his or her taxable income for the year during the HSA owner died. This is true even if the beneficiary withdraws the funds in a following year. The 20% penalty for non-medical use does not apply. Any earnings realized after the death of the HSA owner are included in the beneficiary's income for the withdrawal year. The HSA Custodian/trustee prepares the Form 1099-SA to report the distribution to the beneficiary for the year during which the withdrawal occurs

- The remainder of Part II (Distributions) is to be completed

- If the beneficiary pays within one year of the date of death medical expenses incurred by the HSA owner prior to his or her death, then such amount is to be listed on line 15. At times the beneficiary may need to file an amended tax return.

If the inheriting beneficiary is the HSA owner's estate, the final tax return and Form 8889 for the HSA owner as follows.

- Across the top of the form write, “Death of HSA Owner.

- Part I is to be completed, if applicable. That is, if the HSA owner made contributions prior to his death, they are reported

- On line 14a the HSA fair market value as of the date of death is inserted. This amount is included on the deceased HSA owner's final tax return for the year he or she died. This is true even if the personal representative withdraws the funds in a following year.

- The remainder of Part II (Distributions) is to be completed

- If the estate pays within one year of the date of death medical expenses incurred by the HSA owner prior to his or her death, then such amount is to be listed on line 15. At times the final tax return for the deceased HSA owner may need to file an amended tax return.

There are two times when a person is apparently required to file a paper tax return (versus an electronic filing) and file multiple 8889 forms.

The first situation is the person has his or her own personal HSA and then inherits an HSA. The person must prepare a Form 8889 for each HSA and a summary Form 8889. “Statement is to be written at the top of each of the non-summary 8889 forms. These statements are to be attached to the summary Form 8889. The IRS instructions use the term “controlling 8889”, we prefer “summary 8889.”

Edited on: Tuesday, November 08, 2016 14:18.19

Categories: Health Savings Accounts, Pension Alerts

Thursday, February 06, 2014

Excess HSA Contributions - The HSA Custodian Must Not Shirk its Responsibilities

An HSA custodian is required to prepare and furnish Form 1099-SA (Distributions from an HSA, Archer MSA,or Medicare Advantage MSA) to report distributions received by the HSA owner or an inheriting HSA beneficiary. The individual will use the information from the Form 1099-SA to complete their federal income tax return, including Form 8889 (Health Savings Accounts).The individual explains on this form whether all distributions were used for qualified medical reasons and so they are tax-free, whether some of the distributions are taxable since they were not used to pay a qualified medical expense, or whether some distributions are not taxable since they were the withdrawal of an excess contribution.

The IRS takes the reporting of the withdrawal of excess HSA contributions very seriously. Reason code 2 is to be inserted in box 3 of Form 1099-SA when an HSA owner withdraws an excess contribution. The amount of the earnings, if any, associated with the excess contributionis to be reported in box 2. The IRS procedures applying to the withdrawal of HSA excess contributions are very similar to the rules applying to the withdrawal of excess IRA contributions, but there are some significant differences.

Excess HSA contributions can cause tax problems for an HSA owner, but they also cause administrative problems for the HSA custodian/trustee. The purpose of this article is to discuss the tax rules applying to excess HSA contributions so that an HSA custodian will properly perform its IRS reporting duties and also help its HSA owners. The HSA custodian/trustee may well want to have the authority to charge an administrative fee for the additional work which will need to be performed on account of the excess HSA contribution(s).

Based on a number of consulting calls, some financial institutions are adopting the approach that the institution will report all HSA distributions as normal distributions and then instruct the HSA owner that it is up to him or her (and the accountant) to explain things on the Form 8889

This approach is imprudent as it relies on wishful thinking. This approach is contrary to IRS guidance. The IRS may assess a fine of $50 for each Form 1099-SA prepared in error . If the IRS concludes that an HSA custodian has failed to provide a correct Form 1099-SA due to its intentional disregard of the requirement to furnish a correct Form 1099-SA, then the penalty is at least $250 per form with no maximum penalty. The $250 perform penalty may be assessed twice – once with respect to the copy required to be filed with the IRS and also with respect to the copy to be furnished the HSA owner.

Who is primarily responsible for correcting an excess HSA contribution?

The HSA owner is, but in some situations the HSA custodian must be proactive in making sure the excess contribution is corrected. It is the HSA owner who must pay the 6% excise tax if excess contributions have been made to his or her HSA and they have not been with-drawn by the tax filing deadline. Normally, this is April 15 of the following year. A special tax rules modifies the deadline to October 15 if the individual filed his or her tax return byApril 15 and paid any taxes owing. The 6% tax applies for each year the excess remains in the HSA.

The HSA plan agreement provides that the HSA custodian is NOT authorized to accept annual contributions totaling more than $7,450 for 2013 and $7,550 for2014. This amount is the family HDHP limit plus$1,000. This provision means the HSA custodian must be proactive in correcting excess contributions which have arisen because the individual and the employer contributed more than this limit. Both the individual and the institution have done something they should not have done. The individual made the excess contribution and the institution should not have accepted it. HSA custodians must have a procedure to monitor (and enforce) the $7,450/$7,550 limit.

In order to illustrate some of the administrative issues which may arise from an excess HSA contribution situation, two situations will be discussed.

Situation #1. Sue Taxpayer, age 39, contributed $6,450 to her HSA on April 1, 2013 for 2013. At that time she thought she had family HDHP coverage for allof 2013. However on July 1, 2013, she went to work for a new employer which covered her immediately under a non-HDHP. Thus, she was eligible to contribute only $3,125 to their HSA and so she needs to withdraw her excess contribution of $3,125 plus the related income, if any.

In January of 2014, Sue visits the HSA custodian and states she needs to withdraw $3,125 as an excess HSA contribution plus the related income. The HSA custodian must assist her. The withdrawal cannot be coded as the withdrawal of a normal HSA distribution. Note that even though this distribution relates to a 2013 distribution, it will be reported on a 2014 Form 1099-SA. The rule is – the income, if any, withdrawn and shown inbox 2 is taxable for the year withdrawn (2014) and not 2013 which is the IRA rule.

Situation #2. John Taxpayer contributes $14,000 to his HSA in 2013 for 2013. He says he was unaware of any contribution limit. His beginning balance as of January1, 2013 was $600. He made monthly contributions of$1,000. His HSA’sending balance as of December 31,2013 was $200. His distributions for the year totalled $14,400. Of this $12,400, John knows that $8,800 was used to pay qualified medical expenses and the remaining $5,600 was used to pay the premiums for the HDHP. The institution does not know how John used the funds.

The HSA custodian has initially coded all of the HSA distributions as being normal HSA distributions and a code “1” would be inserted in box 3 on the 2013 Form1099-SA. The HSA custodian, however, knows that John made excess contributions of at least $6,950 ($14,000-$7,450). This amount is no longer in the HSA as it only has a balance of $200 at year end. Whether John knew it or not, when he took a distribution he was withdrawing an excess contribution. The HSA custodian cannot continue to report this amount as the withdrawal of a normal distribution. It must change some of withdrawals to show that he withdrew $7,950 as an excess contribution, plus the earnings, if any.

Be aware that the IRS has not furnished specific guidance on Situation #2. The IRS should do so. Note that John used the funds to pay the premiums for the HDHP. As discussed in a previous newsletter article, if he had taken a normal distribution he would have had to include the $5,600 in income and also pay the 20% penalty tax as the funds were not used to pay a qualified medical expense. But he does not have such adverse tax consequences as he withdrew an excess contribution.

An HSA custodian must adopt procedures to properly report the withdrawal of an excess HSA contribution(s). Such withdrawals must not be reported as normal distributions.

Edited on: Monday, April 14, 2014 15:53.05

Categories: Health Savings Accounts, Pension Alerts

Wednesday, May 18, 2011

IRS Issues 2012 Indexed Amounts for HSAs

IRS Issues 2012 Indexed Amounts for HSAs

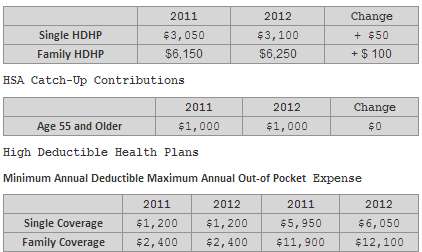

The HSA contribution limits for 2012 are slightly larger than the 2011 limits. The Treasury Department and Internal Revenue Service issued new guidance on the maximum contribution levels for Health Savings Accounts (HSAs) and out-of-pocket spending and deductible limits for High Deductible Health Plans (HDHPs) that must be used in conjunction with HSAs. The 2012 limits are set forth in Revenue Procedure 2011-32. In this revenue procedure, the IRS did not discuss whether the catch-up contribution amount of $1,000 changed. We have assumed it did not change for 2012.

HSA Maximum Contribution Limits

The IRS announces this change in May each year so that employers and individuals will have sufficient time to settle on HDHP insurance coverage and HSA contributions for 2012.

Edited on: Monday, April 14, 2014 15:26.08

Categories: Health Savings Accounts, Pension Alerts