Monday, June 14, 2021

IRA Contribution Limits for 2021 - Unchanged

October 2020

IRA Contribution Limits for 2021 – Unchanged $6,000 and $7,000

The 2021 maximum limits for annual traditional IRA and Roth IRA contributions remain

the same at $6,000 (if under age 50) and $7,000 (if age 50 or older). For 2020 the limits are also $6,000 and $7,000. Federal tax law provides for a change in the contribution limit once the cost of living adjustment equals or exceeds $500. The annual contribution catchup for individuals age 50 or older remains at $1,000 as it is not indexed. Note on page 2 that the compensation limits used to determine the amount an IRA owner who is an active participant is able to claim as a tax deduction for their traditional IRA contribution have increased.

The 2021 maximum contribution limit for SEP-IRAs is increased to $58,000 (or, 25% of compensation, if lesser) up from $57,000. The minimum SEP compensation limit used to determine if an employer must make a contribution for a part-time employee has increased to $650 from $600.

The 2021 maximum contribution limits for SIMPLE-IRAs have not changed. It is $13,500 if the individual is under age 50 and $16,500 if age 50 or older. The catch-up amount of $3,000 has not changed.

The 2021 maximum elective deferral limit for 401(k) participants also has not changed. It is $19,500 for participants under age 50 and $26,000 for participants age 50 and older. The catch-up amount of $6,500 has not changed.

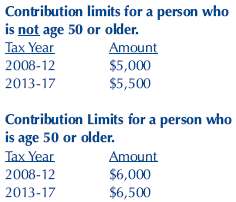

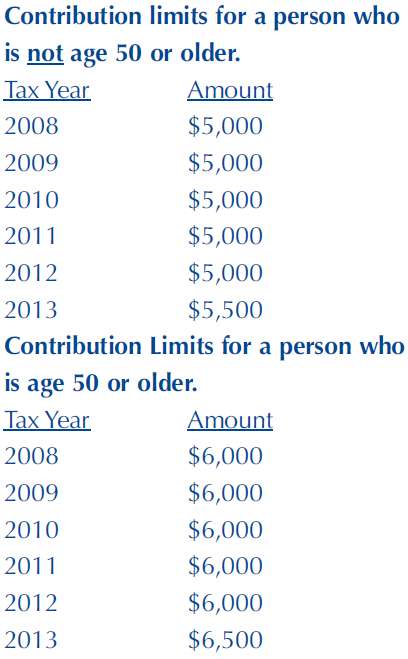

Contribution limits for a person who is notage 50 or older.

Tax Year Amount

2008-12 $5,000

2013-18 $5,500

2019-21 $6,000

Contribution Limits for a person who is age 50 or older.

Tax Year Amount

2008-12 $6,000

2013-18 $6,500

2019-21 $7,000

IRS Guidance on Tax Treatment of Expenses Related to a Qualified Birth or Adoption Distribution

October 2020

IRS Guidance on Tax Treatment of Expenses Related to a Qualified Birth or Adoption Distribution

The SECURE Act created another exception to the 10% additional tax of Code section 72(t). There is now an exception for expenses on account of a birth or an adoption of an individual. Code section 72(t)(2) sets forth the exceptions to the 10% tax. Sometimes an exception applies only to a distribution from an IRA or from an employer retirement plan and sometimes to both. A distribution from either an IRA or a 401(k) plan may qualify for this new exception.

A person is required to include a qualified birth or adoption distribution in their gross income, but the person does not owe the 10% additional tax. A qualified birth or adoption distribution is any distribution of up to $5,000 from an eligible IRA or other applicable retirement plan to a person as long as the distribution is made during the 1-year period beginning on the date of birth of the individual’s child or the date the legal adoption of an eligible adoptee by the individual is finalized.

This section of the article focuses on a qualified birth or adoption distribution from an IRA.

A person who has received a qualified birth or adoptiondistribution is authorized to recontribute the distribution to an eligible plan to which a rollover may be made. A recontribution is another type of rollover. The IRS will in future guidance discuss the recontribution rules, including the rules related to the timing of the recontributions. The statute failed to discuss the deadline for making a recontribution of a qualified birth or adoption distribution and so the IRS will need to furnish guidance. This should be defined in a technical correction tax bill.

The IRS has clarified the following. An individual may receive a qualified birth or adoption distribution of up to $5,000 with respect to the same child or eligible adoptee. If a person is related to multiple births or adoptions, the person may have a qualified birth or adoption distribution with respect to each child or eligible adoptee. If a person is married, each parent may receive a qualified birth or adoption distribution of up to $5,000 with respect to the same child or eligible adoptee.

An eligible adoptee is any individual who has not attained age 18 or is physically or mentally incapable of self-support. A person is considered to be physically or mentally incapable of self-support if the person is disabled as defined in Code section 72(m)(7). That is, the individual is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or to be of long-continued and indefinite duration. However, an eligible adoptee cannot include an individual who is the child of the taxpayer’s spouse.

How does an IRA custodian report these transactions? Code “1” will be used in box 7 of the Form 1099-R. The recontribution (i.e rollover) is to be reported in boxes 14a and b as a repayment. The repayment amount is reported in box 14a and enter “BA” in box 14b for repayment of a qualified birth or adoption distribution. It is not to be reported in box 2 as a rollover or in box 13a as a late certified rollover.

The individual will need to complete their tax return to show their was a qualified birth or adoption distribution. Presumably, the individual will do this by completing the applicable section of Form 5329 and claim exception to the 10% additional tax and attach it to his or her tax return. The individual must include the name, age, and the taxpayer identification number of the child or the eligible adoptee on their tax return for the tax year in which the distribution is made.

If the individual makes a rollover or repayment contribution, then the individual will need to show such rollover contribution on their Form 1040.

This section of the article focuses on a qualified birth or adoption distribution from a 401(k) plans or other defined contribution plan.

An employer is not required to amend its plan to permit an in service distribution which qualify as a qualified birth or adoption distribution. Such an amendment is a discretionary amendment. It is not a mandatory amendment.

If a plan sponsor chooses to amend its plan to provide or a qualified birth or adoption distribution, it must do so by the last day of the first plan year beginning on or after January 1, 2022.

A plan sponsor may rely on a participant’s certification that he or she is eligible for a qualified birth or adoption distribution. If a plan permits a participant to take a qualified birth or adoption distribution, then such plan is required to permit that participant to make a recontribution if such participant is otherwise eligible to make a rollover contribution.

The 401(k) rules restrict the in-service distributions which may be made to a participant. However, there are exceptions, including an exception for certain hardship distributions. A qualified birth or adoption distribution is treated as meeting such an exception. Thus, if the applicable rules are met a participant may withdraw their elective deferrals. qualified non-elective contributions, qualified matching contributions or a safe harbor contribution.

With respect to a participant who is taking a qualified birth or adoption distribution, the plan sponsor is not required to offer a direct rollover or to provide a section 402(f) notice. Because there is no duty to offer a direct rollover the 20% mandatory withholding rule does not apply. The standard withholding rules will apply.

Even though a participant is ineligible under the plan for an in service distribution qualified birth or adoption distribution, such participant may treat on their tax return an otherwise permissible in-service distribution as a qualified birth or adoption distribution.

The IRS will need to issue guidance on the subject, if a participant takes a qualified birth or adoption distribution from their 401(k) account, then is the participant able to make a rollover contribution into the plan or may the person make a rollover into their IRA. At this time we believe the participant may rollover their qualified birth or adoption distribution from their 401(k) plan into their IRA and not into the distributing 401(k) plan.

In summary, there is a new exception to the 10% additional tax which generally applies when a person under age 591/2 takes a distribution from an IRA or pension plan. The new exception is for a qualified birth or adoption distribution.

Edited on: Monday, June 14, 2021 13:09.21

Categories: Traditional IRAs

IRS Guidance on Difficulty of Care Payments Affect on IRAs and Retirement Plans

October 2020

IRS Guidance on Difficulty of Care Payments Affect on IRAs and Retirement Plans

Some individuals in the past who were not eligible to make an IRA contribution may now do so, These individuals are workers who receive difficulty of care payments related to their foster care services.

Internal Revenue Code section 131 provides that a difficulty of care payment, which is a type of foster care payment, is excludable from the taxpayer’s gross income. Under pre-2020 law, such payments were not considered to be qualifying compensation for purposes of making an IRA contribution. The general rule is, in order to make an IRA contribution, regardless if deductible or non-deductible, a person must have taxable income to support the contribution.

In Notice 2020-68 the IRS provides additional guidance.

A new exception to this rule is made for difficulty of care payments. Code section 408(o)(5) was added by the SECURE Act. It provides that an individual with difficulty of care payments is eligible to make certain designated nondeductible contributions to an IRA even though the person does not otherwise have sufficient compensation to make an IRA contribution (lesser of $6,000 if under age 50, $7,000 if age 50 or older or 100% of compensation).

These designated nondeductible contributions are limited. An individual is eligible to make a nondeductible IRA contribution to the extent of the lesser of the amount excluded under section 131 or the maximum IRA contribution amount as reduced by the amount of compensation which is includible in income. For example, Jane Doe, age 39, receives compensation of $11,000 for certain difficulty of care payments. She is able to exclude $9,000 under section 131 and she includes $2,000 in her taxable income. She is limited to make a non-deductible contribution of $4,000. The $4,000 is the lesser of $6,000 as reduced by the $2,000 or $9,000. If Jane Doe’s excludable difficulty of care payments were $5,000 and she has no other taxable compensation, then her nondeductible IRA contribution amount would be limited to $5,000.

The IRS has stated that it will be providing guidance on how the excess contribution rules and reporting are affected by these new difficulty of care payment rules. The IRS will also need to provide guidance if a person is eligible to make a Roth IRA contribution based on difficulty of care payments.

Difficulty of care payment also impact contribution which are made under a qualified plan. In general an employer will make a contribution for a participant only if a participant has compensation for the current year. And the law imposes a maximum amount which can be contributed on behalf of a participant. Under pre-2020 law, difficulty of care such payments were not considered in applying the limitations on annual additions set forth in code sections 415( c)(1) and (2). Under section 415( c)(1 ), a person’s annual additions may not exceed the lesser of $40,000 as increased by annual cost of living adjustments ($57,000 for 2020) or 100% of the participant’s compensation. Under section 415(c)(2) a person’s annual additions are the sum of the employer contributions, employee contributions and forfeitures.

As revised by the SECURE Act a person’s compensation for section 415 purposes is increased by the amount of excludable difficulty of care payments. Thus, a person may make contributions to their account or receive allocations to their account based on these difficulty of care payments even if the person has no other compensation. Such a contribution is treated as investment in the contract and will not cause a plan to be treated as failing any requirements of code sections 1- 1400Z-2. This law change applies to plan years beginning after December 31, 2015. It appears the IRS position is, this law change is a mandatory change and it is not a permissive or discretionary change.

SECURE Act Guidance

September 2020

SECURE ACT Guidance

Including Guidance on IRA Amendments

The IRS issued Notice 2020-68 on September 8, 2020. It furnishes additional guidance for IRA and qualified plans. IRAs (and qualified pension plans) are subject to the rule that in order to take a certain action the plan document must authorize that action, be it a contribution, a distribution, or an investment. The law is complicated because the IRS requires certain laws be set forth in the plan document for the plan document to be qualified and entitled to receive the associated tax benefits. Other laws are permissive and are not required to be set forth in the IRA plan agreement for the IRA or qualified plan to be qualified.

It’s been a long time since the IRS has discussed the topic of an IRA custodian’s duty to furnish an IRA amendment. Many institutions have adopted the approach, since the IRS hasn’t said anything about amendments, we don’t need to furnish our existing IRA accountholders and beneficiaries with an IRA amendment. The IRS has now spoken.

The SECURE Act repealed the age 701/2 and older eligibility contribution rule. A person older than age 701/2 is now eligible to make an IRA contribution as long as they have qualifying compensation. The IRS has stated a financial institution serving as the IRA custodian/trustee may accept such a contribution and the individual is authorized to make such a contribution only if the IRA is amended. If the IRA has not been amended, such contribution is unauthorized. Presumably it would be an excess contribution subject to the 6% excess contribution tax. The other alternative is, the IRA becomes unqualified because of the SECURE Act and the CARES Act and there is a deemed distribution.

In general, both the IRA plan agreement and the IRA disclosure statement must be amended.

The IRS cited the governing regulation for when the IRA must be amended. The IRS indicates it will be modifying its model IRA forms, but the IRS did not furnish a tentative date for doing so. The IRS must revise the Article four dealing with the required distribution rules. These RMD law changes are mandatory and are not permissive. In general, such amendments must be adopted by December 31, 2022.

Note that for a permissive law change, the IRA custodian may amend some customer IRAs, but not others. This would create some administrative complexities. For example, the IRAs of all individuals aged 701/2 or older could be amended and not those under age 701/2 in 2020. A mandatory law change requires all existing IRAs be amended.

The IRA plan agreements set forth in CWF’s IRA FormSystem have been revised to set forth the changes made by the SECURE Act and the CARES Act including the right of a person age 701/2 or older to make a contribution as long as the person has qualifying compensation. Those institutions which have purchased CWF’s 2019-2020 IRA amendment may accept such IRA contributions.

We at CWF are able to furnish an IRA custodian with an IRA amendment. Send us an email and we will contact you to discuss your situation. Many institutions will want to furnish an IRA amendment by January 31, 2021, in order to realize cost savings from a combined mailing. We may assist you even if your IRA plan agreement has not been provided written by CWF, but another IRA vendor.

Wednesday, November 01, 2017

DOL Finalizes 18 Month Fiduciary Rules Extension

On November 27, 2017 the U.S. Department of Labor announced an 18-month extension from January 1, 2018 to July 1, 2019, of the special transition period for the Fiduciary Rule’s Best Interest Contract Exemption, the Principal Transactions Exemption and of the applicability of certain amendments to the Prohibited Transaction Exemption 84-24.

On August 31, 2017 the EBSA/DOL had issued a proposed rule extending the transition period. Such rule is now final.

During this transition period the DOL will continue its review under the Presidential Memorandum of February 3, 2017, to review public comments, and decide whether to propose further changes. During this transition period, a fiduciary advisor who makes an investment recommendation has the duty to give advice that conforms to “impartial conduct standards.” There is no requirement that an IRA custodian or trustee must furnish an investment recommendation. An advisor must adhere to a best interest standard when making investment recommendations, charge no more than reasonable compensation and not make any misleading statements. The DOL has stated it is extending its temporary enforcement policy set forth in Field Assistance Bulletin 2017-02. The DOL will treat a fiduciary as being in compliance during this transition period as long as the fiduciary is working diligently and in good faith to comply with the transition rules. Unless modified, the exemptions’ remaining requirements will be come effective on July 1, 2019.

One of the main reasons to furnish 2017-2018 IRA Amendments is to discuss the Fiduciary rule and the transition rules.

Monday, May 08, 2017

CWF's Primer on IRA Rollover Rules

There are seven (7) IRA rollover rules:

- An RMD is never eligible to be rolled over

- A person is authorized to rollover only one distribution within a 12 month period

- The rollover must be completed within 60 days

- An inherited IRA (non-spouse beneficiary) is never eligible to roll over a distribution from an inherited IRA

- 5. If property is distributed (and not cash), such property must be a rollover The property cannot be sold and the proceeds rollover over as is the case when property is distributed from a qualified plan

- SIMPLE IRA funds may be rolled over into a traditional IRA, SEP-IRA or a 401(k) or vice versa only if the individual has met the 2 year requirement

- Roth IRA funds can only be rolled over into the same or a different Roth IRA.

A person who fails to comply with all of the above 7 rules is ineligible to make a rollover contribution.

The IRS has been granted the authority by a 2001 tax law to grant relief to someone who has missed the 60 day rule because he or she incurred some difficulty or hardship and it would be unjust, or inequitable for the IRS to not waive the 60 day rule. Waive means the IRS creates a new 60 day period for the individual to complete the rollover.

The IRS' position is - it does not have the statutory authority to grant rollover relief to a person who fails to comply with any of the other rollover rules.

The IRS can't grant relief to any person who has taken multiple IRA distributions during a twelve month and makes an ineligible rollover contribution.

The IRS can't grant relief to a nonspouse beneficiary who was paid a distribution by an IRA trustee. The IRS can't grant relief and allow someone to roll over a required distribution.

The IRS can't grant relief if a person receives an in-kind distribution from his or her IRA, sells the asset, and then impermissibly rolls over the sales proceeds. If a distribution is ineligible to be rolled over but it is contributed as a rollover, such distribution will need to be included in the individual's taxable income and it will be an excess contribution subject to the excess contribution rules until corrected by withdrawal.

Monday, October 31, 2016

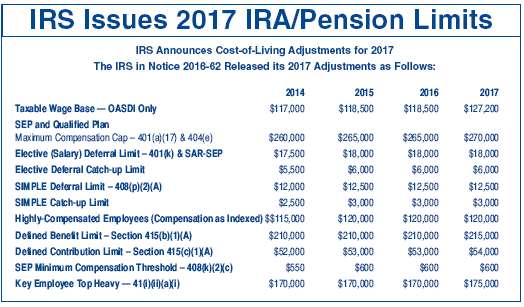

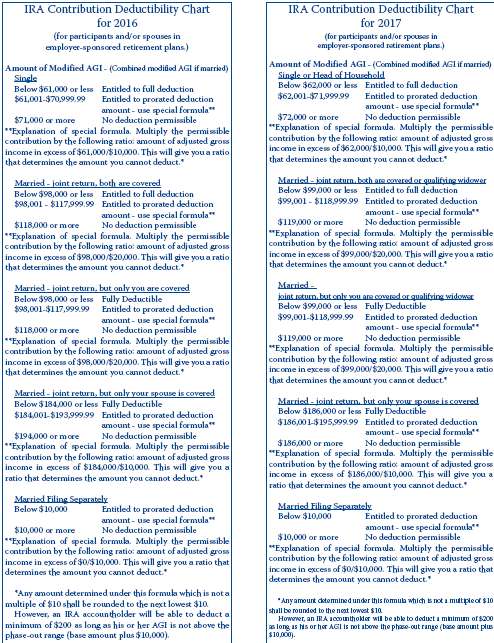

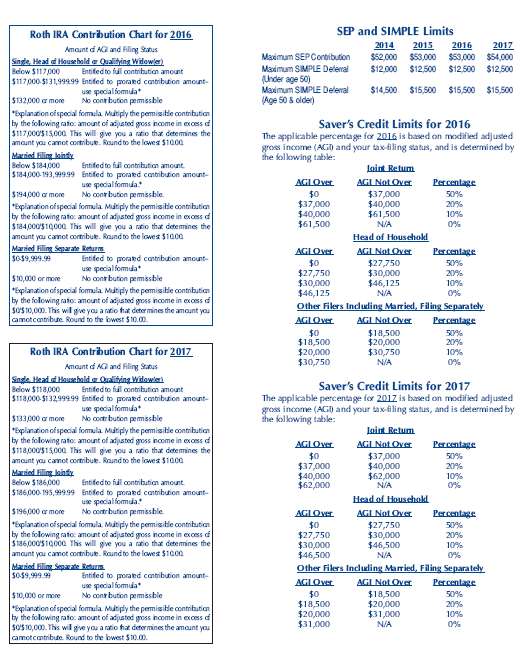

IRA Contribution Limits for 2017 – Unchanged at $5,500 and $6,500; 401(k) Limits Unchanged Also

Inflation was approximately .3% for the fiscal quarter ending September 30, 2016, so many of the IRA and pension limits as adjusted by the cost of living factor have not changed or the changes have been quite small.

The maximum IRA contribution limits for 2017 for traditional and Roth IRAs did not change – $5,500/$6,500.

The 2017 maximum contribution limit for SEP-IRAs is increased to $54,000 (or,25% of compensation, if lesser) up from $53,000. The minimum SEP contribution limit used to determine if an employer must make a contribution for a part-time employee remains the same at $600.

The 2017 maximum contribution limits for SIMPLE-IRAs is unchanged at $12,500 if the individual is under age 50 and$15,500 if age 50 or older.

The 2017 maximum elective deferral limit for 401(k) participants is unchanged at $18,000 for participants under age 50 and $24,000 for participants age 50 and older.

Edited on: Tuesday, November 08, 2016 14:21.07

Categories: Pension Alerts, Roth IRAs, SIMPLE IRAs, Traditional IRAs

Wednesday, September 28, 2016

Financial Institution Must Notify DOL It Will Use BICE And Must Comply With Record Keeping Requirements

In order to use the BICE a financial institution must notify the DOL by providing an email to e-bice@dol.gov that it will to use the BICE. The notice can be generic. That is, it need not mention any specific IRA or any specific plan. If the notice requirement has been met, then the financial may receive compensation. The notice remains in effect until it would be revoked by the financial institution.

The financial institution must maintain for six years the records necessary for certain persons to determine whether the conditions of the BICE have been met with respect to each specific transaction. Upon request the following individuals must have the right to exam these records during normal business hours:

- Any authorized employee or representative of the IRS

- Any plan fiduciary which has participated in an investment transaction pursuant to the BICE

- Any authorized employee or representative of a plan fiduciary which has participated in an investment transaction pursuant to the BICE

- Any contributing employer and any employee organization whose employees or members are covered by the plan

- Any authorized employee or representative of a contributing employer and any employee organization which has participated in an investment transaction pursuant to the BICE

Any IRA owner or plan participant or inheriting beneficiary or an authorized representative of such persons.

None of the non-IRS individuals are authorized to examine records regarding a recommended transaction of another retirement investor, privileged trade secrets or privileged commercial or financial information of the financial institution or information identifying other information.

When a financial institution refuses to furnish requested information for a reason state above, it has 30 days in which to inform the requester of the reasons for denying the request and that the DOL if requested could request such information.

If the required records are not maintained, there is a loss of the exemption only for that transaction or transactions for which the records are missing or have not been maintained. Other transactions will still qualify for the BICE if those records are maintained. If the records are lost or destroyed, due to circumstances beyond the control of the financial institutions, then no prohibited transaction will be considered to have occurred solely on the basis of the unavailability of those records.

The financial institution is the party who is responsible to pay the ERISA civil penalty under section 502 or the taxes under section 502 or the taxes under section 4975 if the required records are not maintained

Edited on: Tuesday, November 08, 2016 14:20.33

Categories: Pension Alerts, Traditional IRAs

Wednesday, September 21, 2016

Election Day November 8th, 2016 and the Politics of IRAs.

You and other voters will go the voting booth on November 8th, 2016.

IRAs are political because they are created by the federal income tax laws. IRA owners receive tax preferences for making various types of IRA contributions or because the IRA has received a direct rollover or rollover contribution from a 401(k) plan or another employer sponsored retirement plan.

The federal deficit is a political issue waiting to be addressed. More and more politicians are starting to seriously look at IRAs and 401(k) plans as sources of tax revenues. Money in traditional, SEP and SIMPLE IRAs is tax deferred, it is not tax-free. When distributed or withdrawn, the distribution amount must be included in the recipient's income and tax paid at the person's applicable marginal income tax rate.

There is approximately 7.2 trillion dollars in traditional IRAs. Assuming an average marginal tax rate of 20% the federal government is looking to collect 1.4 trillion dollars from future IRA distributions. There is approximately 6.8 trillion dollars in 401(k) and other defined contribution plans. Assuming an average marginal tax rate of 20% the federal government is looking to collect 1.3 trillion dollars from future 401(k) distributions. The federal debt is estimated to be 19.5 trillion dollars as of September 30, 2016. IRAs and 401(k) plans cover 13.8% of the federal debt.

The question is, when will these tax revenues be collected?

Some politicians are starting to suggest the IRA rules need to be changed so the federal government starts to collect tax revenues sooner than under existing law.

Senator Ron Wyden represents the State of Oregon. He is a Democrat. There is a 50% chance he will become the chairman of the Senate Finance Committee in 2017 after the November 8th elections. He recently communicated that he and other Democrats will be pursuing the following IRA law changes.

- With respect to inherited IRAs, the 5-year rule would apply once an IRA owner dies. This would be a monumental change. A traditional IRA beneficiary would have 5-6 years to take distributions, include such amounts in income and pay tax. The ability to stretch out distributions over the beneficiary's life expectancy would be repealed. A Roth IRA beneficiary would lose the right to have the Roth IRA earn tax-free income for a period equal to his or her life expectancy. The beneficiary would be given only 5-6 years of tax-free income

-

It is unclear if everyone would lose the right to make Roth IRA

conversion contributions or if a person with traditional IRA funds

could make a conversion contribution but only to the extent the IRA

funds are taxable. That is, a person with basis in his/her IRA or

pension plan could not convert any basis. The Obama administration has

previously proposed not allowing basis within an IRA to be converted.

A total repeal of the right to make a Roth IRA conversion contribution

would be radical.

At least on a short term basis, the federal government likes it when individuals make Roth IRA conversion contributions as tax revenues are collected.

- There would be a new tax rule stipulating that the maximum value of a person's Roth IRAs would be limited to $5,000,000 and if this limit was exceeded then the excess would have to be withdrawn. This also would be a radical change.

- A non-IRA change would be to change the law governing 401(k) plans. Somehow a person making student loan payments would be given credit under their 401(k)plan so that the loan payments would be treated as an elective deferral contributions so that an employer would have to make a matching contribution.

In summary, IRAs are political. As with other political subjects, each person will need to make their own voting decisions. Taking away IRA tax preferences is in essence a tax increase and individuals will need to decide the degree it will influence how they will vote. We at CWF believe switching to the 5-year rule for an inherited IRA beneficiary should be unacceptable.

Edited on: Tuesday, November 08, 2016 14:20.16

Categories: Pension Alerts, Traditional IRAs

Monday, August 15, 2016

IRS Issues Additional Procedure For Waiver of 60-Day Rollover Requirement and Additional Self-Certification Procedure

The IRS issued Revenue Procedure 2016-47 on August 24, 2016. It modifies Revenue Procedure 2003-16. The IRS now in the course of a examining a taxpayer’s individual tax return may determine that the person qualifies for a waiver of the 60-dayrollover requirement.

The IRS has created a third waiver method. The new waiver method is effective on August 24, 2016. The first waiver method set forth in Revenue Procedure 2003-16 requires the taxpayer to file an application requesting a waiver of the 60-day rule and the IRS must grant the waiver. The second waiver method authorizes an automatic waiver of the 60-day rule if four requirements are met.

Why this new IRS procedure?

In January of 2016 the IRS changed

the filing fees that a taxpayer must pay when submitting his or her

waiver application. In 2015, the filing fee was $500 if the purported

rollover was less than $50,000, $1,500 if the rollover amount was less

than $100,000 but equal to or more than $50,000 and $3,000 if the

rollover amount was $100,000 or more.

The IRS increased the fee to $10,000 for all such waiver applications. Apparently the IRS concluded that it no longer could afford to assign the personnel it had assigned to process these waiver requests. Presumably, many taxpayers and tax professionals have expressed their dissatisfaction to the IRS. The $10,000 filing fee means many taxpayers are no longer able to have the IRS process their application and receive a concrete ruling that they were or were not entitled to a waiver of the 60-day rule. The application process provided a taxpayer with tax certainty.

In Revenue Procedure 2016-47 the IRS authorizes a self-certification procedure that a taxpayer may use to request the waiver of the 60-day requirement rather than using the application procedure.The IRS tentatively grants the waiver upon the making of the self-certification and the taxpayer is permitted to prepare his or her tax return to reflect that he or she made a complying rollover so the distribution amount is not required to be included in his or her taxable income. However, the IRS retains the right to examine the individual’s tax return for such year (i.e. Audit) and determine if the requirements for a waiver of the 60-day rule were or were not met. If the IRS determines the individual was not entitled to a waiver of the 60-day rule, the individual will have to include such distribution in his or her income and will have an excess IRA contribution situation needing to be corrected. The IRS explanation gives a limited discussion of the adverse consequences. If the IRS does not grant the waiver then the person may be subject to income and excise taxes, interest and penalties. One of the penalties which might apply would be the 25% tax for understating one’s income.

This self-certification procedure applies to distributions from any type of IRA and also from a 401(k) plan or other qualified plan and certain 403(b) and 457 plans.

The IRS has stated that it will be modifying the Form 5498 so that an IRA custodian which accepts a rollover contribution pursuant to this self-certification procedure after the 60-day deadline will complete such person’s Form 5498 to report that the rollover contribution was accepted after the 60-day deadline. The IRS will then be able to examine the tax returns of these taxpayers and the purported rollovers.

How does this self-certification procedure work?

The IRA owner

will furnish the IRA custodian/trustee with a written certification

meeting the following requirements. The IRA owner may use the IRS’ model

letter set forth in the appendix of Revenue Procedure 2016-47 on a

word-for-word basis or by using a form or letter that is substantially

similar in all material respects.

The requirements:

- The IRS must not have previously denied a waiver with respect to a rollover of all or part of the distribution involved in the late rollover

- The IRA owner must make his or her rollover contribution as soon as practicable once the reason(s) for missing the 60-day deadline no longer apply. This requirement is deemed satisfied if the rollover contribution is made within 30 days after the reason or reasons no longer prevent the IRA owner from making the rollover contribution.

- The taxpayer must have missed the 60-day deadline for one or more of the following reasons:

- An error was committed by the financial institution making the distribution or receiving the contribution

- The distribution was in the form of a check and the check was misplaced and never cashed

- The distribution was deposited into and remained in an account that you mistakenly thought was a retirement plan or IRA

- Your principal residence was severely damaged

- One of your family members died

- You or one of your family members were seriously injure

- You were incarcerated

- Restrictions were imposed by a foreign country

- A postal error occurred

- The distribution was made on account of an IRS levy and the proceeds of the levy have been returned to you

- The party making the distribution delayed providing information that the receiving plan or IRA required to complete the rollover despite my reasonable efforts to obtain the information.

A person whose reason for missing the 60-day requirement is not included in the list of reasons is unable to use this self-certification procedure. The IRA custodian is authorized to rely on the IRA owner’s self-certification for purposes of accepting the rollover and reporting it unless it has actual knowledge contrary to the self-certification.

The IRS has created this self-certification method because it had to have some alternative procedure to allow taxpayers to seek a waiver of the 60-day rule as discussed in Revenue Procedure 2003-16 as the increased filing fee meant most taxpayers no longer would be using the application process.

This new procedure will help some taxpayers, but it would not have been needed if the IRS would not have imposed the $10,000 filing fee. One can hope the IRS will see reason and will reduce the fees for 2017. Most likely the IRS will not. Although the 11 reasons the IRS lists as warranting the waiver of the 60-day rule are certainly welcomed by taxpayers, there are certainly other reasons for which the IRS should grant relief

Edited on: Tuesday, November 08, 2016 14:19.57

Categories: Pension Alerts, Traditional IRAs

Monday, July 11, 2016

Planning Suggestion for an IRA Beneficiary Designation-Consider the Primary Beneficiary Might Want to Disclaim

An IRA accountholder should almost always designate a primary beneficiaryand also designate one or more contingent beneficiary(ies). In some older IRA files the IRA accountholder has not designated a contingent beneficiary. In such situation, almost all IRA plan agreement forms provide that the IRA funds will then be paid to the decedent's estate. Tax options are not as many or as beneficial when an estate is the inheriting IRA beneficiary.

Be nice to your IRA clients and remind them periodically they should review and update their beneficiary designations, if appropriate. Of course, your IRA accountholders should be seeking the guidance of their legal and tax advisers.

Situation. John and Mary are now intheir 80's. Mary has $115,000 in her IRA. John has his own IRA with a balance approximating $75,000. Each has designated the other as their IRA beneficiary, but they did not designate any contingent beneficiaries. They have two daughters and a son. Mary died on July 8, 2016.

John has come into the bank because he wants these funds to go to the three children rather than himself. He believes this is what Mary wanted. That is, he wants three inherited IRAs set up for the three children.

The IRA custodian must not accommodate him. It would be tax fraud. It cannot be done since Mary had not designated the children as her contingent beneficiaries. If she would have designated the three children as her contingent beneficiaries and then John would have executed a valid disclaimer, then the desired result of having these IRA funds be inherited by the three children could have been realized. But this was not done.

If John executes the disclaimer now, Mary's estate will inherit her IRA and would have to comply with the RMD' rules applying to an estate beneficiary. John most likely would be making the situation worse. He will be better-off if he elects to treat Mary's IRA as his own and then withdraws only the RMD each year. He will, of course, name his three chi-dren as his IRA beneficiaries.

In summary, be nice to your IRA clients and remind them periodically they should review and update their beneficiary designations. In order to retain the flexibility of a primary beneficiary disclaiming his or her interest, one or more contingent beneficiaries need to have been designated by the deceased IRA accountholder. If so, additional planning options are then available

Edited on: Tuesday, November 08, 2016 14:19.33

Categories: Pension Alerts, Traditional IRAs

Tuesday, June 07, 2016

More Wealthier Individuals Should Be Making Nondeductible Traditional IRA Contributions - They Just Need Some Help and You Can Provide It

Wealthier individuals should be rushing to their bank to make a non-deductible IRA contribution. This is certainly true if they are a 401(k) participant.

This author admits his bias, many individuals should be making non-deductible traditional IRA contributions and they don’t do so because they (and their advisors) many times don’t understand the benefits, including how the related tax rules apply.

Every person should contribute as much as possible to a Roth IRA. Why? There are very few times under US income tax laws where INCOME is not taxed. That is, no taxes are owed with respect to Roth IRA funds if the Roth owner has met a 5-year rule and is age 59½ or older or the Roth owner is a beneficiary who has inherited the Roth IRA and the 5-year rule has been met.

The federal tax laws have been expressly written to make it impossible for a person with a high income to make an annual Roth IRA contribution. Some people (i.e. many Democrats) don’t want “wealthier” individuals to gain the benefit of contributing funds to a Roth IRA and earning tax-free income. They want them to pay more income taxes. A person who had tax filing status of single was ineligible to make a 2015 Roth IRA contribution if his or her MAGI (modified adjusted gross income) was $132,000 or more. A person who had filing status of married filing jointly was ineligible to make a 2015 Roth IRA contribution if the couple’s MAGI (modified adjusted gross income) was $193,000 or more. A person who had filing status of married filing separately was ineligible to make a 2016 Roth IRA contribution if his or her MAGI (modified adjusted gross income was $10,000 or more.

For discussion and illustration purposes, we will assume that Jane Doe has the following situation. She is age 54. She is married. Her husband, Mark Doe, is a bank president. He is age 57. Their joint income is sufficiently high that neither one of them is eligible to make an annual Roth IRA contribution. Their joint income is sufficiently high that neither one of them is eligible to made a deductible traditional IRA annual contribution.

This article is going to discuss the question, “should these two each make a non-deductible traditional IRA contribution?” The primary concern is Jane’s situation, but we will also discuss Mark’s situation.

For the reasons discussed below, both should make a maximum non-deductible traditional IRA contribution until each is no longer eligible to make a traditional IRA contribution (i.e. the year a person attains age 70½).

On March 15, 2016, Jane contributed $6,500 to a traditional IRA she had established in 1984. She designated her contribution as being for 2015. The IRA balance at the time of contribution was $8,500. With the addition of her $6,500 contribution the IRA balance became $15,000. Since then the account has earned $40 of interest.

It is now assumed that Jane has no other IRA funds in any traditional, SEP or SIMPLE IRAs. The IRA taxation rules require in applying the taxation rules that all non-Roth IRA funds be aggregated. One cannot avoid the pro-rata taxation rule by setting up separate IRAs or having separate time deposits.

The couple’s tax preparer has recently informed Jane that her contribution is non-deductible as her husband participates in a 401(k) plan and their MAGI is sufficiently high that they are not permitted to claim any tax deduction for her $6,500 contribution. What tax options are available to her? What options are unavailable to her?

- She may not use the recharacterization rules to make her traditional IRA contribution a Roth IRA contribution as their 2015 MAGI is too high

- There is no IRS guidance allowing the IRA custodian to switch the year for which the IRA contribution was made from 2015 to 2016

- The IRS has issued rules allowing her to withdraw her 2015 IRA contribution with no adverse tax consequences as long as she does so by 10-15-16, no deduction is claimed on the 2015 tax return and the related income is withdrawn. If she withdraws her $6,500 contribution she is required to withdraw the related income and it is taxable for 2016 since the contribution was made in 2016. The related income is a pro-rata amount of the $40 determined as follows: 6500.15000 x $40 = $17.33. Since she is younger than age 59½ she does owe the 10% additional tax on this $17.33. The bank as the IRA custodian will prepare a 2016 Form 1099-R inserting the codes (81) in box 7, box 1 would show $6,517.33 and box 2a would show $17.33

- In 2016 she is eligible to make a Roth IRA conversion of any amount in the range of $.01 to $15,040. If she would convert $15,040 into her Roth IRA she/they would include in income on their 2016 tax return the amount of $8,540. She as many taxpayers does not want to include the $8,540 in her/their income and pay tax on it.

Jane as many taxpayers would like to convert only her non-deductible contribution of $6,500. This would allow her to pay no taxes since she would not be converting any of the $8,540.

The tax rules require use of the standard pro-rata taxation rule when an IRA has taxable funds and non-taxable funds. If she converts $6,500, a portion would be taxable and a portion would not be. The taxable portion is: $6,500 x $8,540/$15,040 ($3,690.82) and the non-taxable portion is $6,500 x $65,00/15,040 ($2809.18) . Jane made a nondeductible IRA contribution for 2015. She is required to file Form 8606 and attach to the couple’s Form 1040. If it was not filed with the original return, an amended tax return should be filed and the 2015 Form 8606 attached. She is not relieved of this duty because she withdraws the $6,500 or converts it. A $50 penalty applies to a person who fails to file Form 8606 unless she could show a reasonable cause why she did not file it. A person must pay a $100 penalty if a person overstates the amount of nondeductible contributions.

Note that Jane will also be required to file a 2016 Form 8606 regardless if she withdraws a portion or all of the $6,500.

Having to include in income the amount of $8540 and pay tax on this amount should not influence Jane or any other wealthy person to not make non-deductible contributions. But it does. Tax on $8540 should not be that material to a couple who are ineligible to make annual Roth IRA contributions.

From a practical standpoint, Jane could convert her traditional IRA over a 2-4 year time period to lessen the amount of income which would be taxed each year.

The best of all “planning” situations would be if Jane would either work for an employer that had a 401(k) plan written to accept rollovers from traditional IRAs or if she could work for the bank and become eligible under the bank’s 401(k) plan. Why? If Jane was a participant of a 401(k) plan, the tax rules have been so written that if she wants to make a rollover contribution, the amount rolled over “first” is the taxable portion. The prorate rule does not apply in this situation.

If Jane only rolls over $8,540, this means that the $6,500 remaining in the IRA are non-taxable. She may then convert such amount to a Roth IRA. This is her goal, this any person’s goal.

In summary, Jane wants to make as make non-deductible IRA contributions (currently $6,500 but his amount which change as it is indexed for inflation) as she can between ages 54-701/2 because she should convert all such funds into a Roth IRA.

What about her husband, Mark? He too wants to make the maximum amount of nondeductible IRA contributions from ages 57-70½ and at some point convert such contributions to a Roth IRA. The sooner the conversion can be completed the better as the earnings realized after the conversion will be tax-free if the qualified distribution rules are met.

Most likely Mark participates in a 40(k) plan which will allow him to move “taxable” IRA money into his 401(k) account. If not, he probably has the ability to rewrite the plan so he would have this right.

The 401(k) plan in which he participates may allow him to make Designated Roth deferrals and he exercises that right to the maximum. This would be $24,000 for 2016 ($18,000 + $6,000). Good for him. But why not contribute an additional $6,500 to his traditional IRA as a non-deductible contribution and convert it? Contributing $6500 for 12 years would result in an additional $78,000 in a Roth IRA.

In summary, Mark too should want to make as many non-deductible traditional IRA contributions as he is eligible for until he is no longer eligible to make traditional IRA contribution.

Edited on: Tuesday, November 08, 2016 14:19.19

Categories: Pension Alerts, Traditional IRAs

Warning – Determine if Your IRA Processor Has Prepared Some of Your Institution’s 5498 Forms Incorrectly

An IRA custodian called CWF with the following situation/question. Jane Doe has her own personal traditional IRA and she has an inherited traditional IRA arising from her mom. The IRA processor prepared just one combined 2015 Form 5498. Is this correct or permissible?

It is incorrect. Two 5498 forms must be prepared. It is understandable why a software engineer would think that it is better and simpler if just one form 5498 record is prepared rather than multiple forms. It is not simpler. The IRS rules do not permit aggregation of the data when there are multiple IRA plan agreements. The IRS has had the rule for a long time that contributions, distributions and fair market value statements are prepared and reported on a per plan agreement basis.

IRA tax data may be aggregated on a per IRA plan agreement basis, but it is not permissible to aggregate data from multiple IRA plan agreements. For example, Jane Doe age 53 has IRA Plan #1 and makes three $2,000 contributions for tax year 2015 on 3/10/15, 9/10/15 and 3/1/16 and she made a rollover contribution from a 401(k) plan to IRA Plan #1 of $12,000 on 6/10/15 and another rollover contribution from her 401(k) plan of $23,000 on 10/10/15. Box 1 will be completed with $6,000 and box 2 will be completed with $35,000.

As the discussion below illustrates, there is tax logic to the rule that there must be a separate IRA reporting form prepared on a per IRA plan agreement basis rather than allowing the reporting entity to aggregate the information and then furnish one form.

For example, Jane Doe has her own traditional IRA and she has has also inherited her mom’s traditional IRA. There must be two also separate 5498 forms prepared for her. For income taxation purposes she does not aggregate her IRA with the inherited IRA from her mother.

Preparation of a combined Form 5498 is a violation of IRS requirements. The IRS has the authority to assess a fine of $50 for each incorrect form and $50 for each missed form. Remember, the fines are doubled in the sense that one form goes to the IRS and one copy to the individual. Most likely the processor in its contract tries to have the IRA custodian be liable for this type of mistake. It’s CWF opinion that if the processor has written its software to not comply, it should be liable for any IRS fines.

What tax harm is being caused by such impermissible aggregation?

A person must do separate tax calculations for distributions from personal IRAs and inherited IRAs. This capability is lost if the data is aggregated.

If two 5498 forms both show a rollover contribution, most likely the IRS will determine that only one of them qualifies to be a rollover contribution because of the once per year rule and the other would be a taxable distribution. This audit capability is lost if there is just one combined Form 5498 prepared. The IRS prepares many statistical studies based on the info set forth on the 5498 forms. Many analytic capabilities are lost if there is not one Form 5498 prepared for each plan agreement.

Edited on: Tuesday, November 08, 2016 14:18.56

Categories: Governmental Reporting, Pension Alerts, Traditional IRAs

Thursday, June 02, 2016

CWF's Guidance on Transfers and Direct Rollovers

Direct rollovers from 401(k) plans into traditional IRAs average more than $75,000.

The tax rules applying to a transfer contribution are very different from those applying to rollover contribution (direct or indirect).

Procedures must exist to minimize IRA custodian errors. Errors arise because IRA personnel do not understand that the tax rules differ from transfers and direct rollovers. They are not the same and IRA staff sometimes fail to know this.

For example, a check for $65,000 is sent to First State Bank (FSB) fbo Jane Doe's traditional IRA. The personnel of First State Bank process the contribution as a transfer as they forget to ask the question, "what type of plan issued the check?". The problem is, the check was issued because Jane Doe had instructed her former employer's 401(k) plan to directly roll over her 401(k) funds to a traditional IRA. Since the check was processed as a transfer, FSB did not report this contribution on the Form 5498 as a rollover as it is required to do. No doubt the IRS will contact your customer who will contact you and the IRS will be interested in learning why FSB did not report this rollover on the Form 5498.

Solution. Determine that you and your IRA staff know what is needed to be known regarding transfers, direct rollovers and rollovers. We at CWF can assist. Call us at 800.346.3961 or visit our website for information on webinars, IRA Tests, IRA Procedure Manual and IRA Rollover Certification Forms.

If your IRA rollover form has a print or revision date prior to 2015, it is obsolete and should be discarded.

Edited on: Tuesday, November 08, 2016 14:18.32

Categories: Pension Alerts, Traditional IRAs

Tuesday, May 24, 2016

CWF Discusses - Non-Deductible Traditional IRA Contributions by Bank Presidents and other High Income Individuals

More Wealthier Individuals Should Be Making Non-deductible Traditional IRA Contributions - They Just Need Some Help and You Can Provide It.

Wealthier individuals should be rushing to their IRA custodian/trustee to make a non-deductible IRA contribution. This is certainly true if they are a 401(k) participant.

Many individuals should be making non-deductible traditional IRA contributions and they don’t do so because they (and their advisors) many times don’t understand the benefits, including how the related tax rules apply. Every person should contribute as much as possible to a Roth IRA. Why? There are very few times under US income tax laws where Income is not taxed. That is, no taxes are owed with respect to Roth IRA funds if the Roth owner has met a 5-year rule and is age 59½ or older or the Roth owner is a beneficiary who has inherited the Roth IRA and the 5-year rule has been met.

The federal tax laws have been expressly written to make it impossible for a person with a high income to make an annual Roth IRA contribution. Some people (i.e. many Democrats) don’t want “wealthier” individuals to gain the benefit of contributing funds to a Roth IRA and earning tax free income. They want them to pay more income taxes. A person who had tax filing status of single was ineligible to make a 2015 Roth IRA contribution if his or her MAGI (modified adjusted gross income) was $132,000 or more. A person who had filing status of married filing jointly was ineligible to make a 2016 Roth IRA contribution if the couple’s MAGI was $193,000 or more. A person who had filing status of married filing separately was ineligible to make a 2016 Roth IRA contribution if his or her MAGI was $10,000 or more.

For discussion and illustration purposes, we will assume that Jane Doe has the following situation. She is age 54. She is married. Her husband, Mark Doe, is a bank president. He is age 57. Their joint income is sufficiently high that neither one of them is eligible to make an annual Roth IRA contribution. Their joint income is sufficiently high that neither one of them is eligible to made a deductible traditional IRA annual contribution.

This article is going to discuss the question, “should these two each make a non-deductible traditional IRA contribution?” For the reasons discussed below, both should make a maximum non-deductible traditional IRA contribution until each is no longer eligible to make a traditional IRA contribution (i.e. the year a person attains age 70½).

On March 15, 2016, Jane contributed $6,500 to a traditional IRA she had established in 1984. She designated her contribution as being for 2015. The IRA balance at the time of contribution was $8,500. With the addition of her $6,500 contribution the IRA balance became $15,000. Since then the account has earned $40 of interest. It is now assumed that Jane has no other IRA funds in any traditional, SEP or SIMPLE IRAs. The IRA taxation rules require in applying the taxation rules that all non-Roth IRA funds be aggregated. One cannot avoid the pro-rata taxation rule by setting up separate IRAs or having separate time deposits.

The couple’s tax preparer has recently informed Jane that her contribution is non-deductible as her husband participates in a 401(k) plan and their MAGI is sufficiently high that they are not permitted to claim any tax deduction for her $6,500 contribution. What tax options are available to her? What options are unavailable to her?

She may not use the recharacterization rules to make her traditional IRA contribution a Roth IRA contribution as their 2015 MAGI is too high.

There is no IRS guidance allowing the IRA custodian to switch the year for which the IRA contribution was made from 2015 to 2016.

The IRS has issued rules allowing her to withdraw her 2015 IRA contribution with no adverse tax consequences as long as she does so by 10-15-16, no deduction is claimed on the 2015 tax return and the related income is withdrawn. If she withdraws her $6,500 contribution she is required to withdraw the related income and it is taxable for 2016 since the contribution was made in 2016. The related income is a pro-rata amount of the $40 determined as follows: 6500.15000 x $40 = $17.33. Since she is younger than age 59½ she does owe the 10% additional tax on this $17.33. The bank as the IRA custodian will prepare a 2016 Form 1099-R inserting the codes (81) in box 7, box 1 would show $6,517.33 and box 2a would show $17.33.

In 2016 she is eligible to make a Roth IRA conversion of any amount in the range of $.01 to $15,040. If she would convert $15,040 into her Roth IRA she/they would include in income on their 2016 tax return the amount of $8,540. She as many taxpayers does not want to include the $8,540 in her/their income and pay tax on it. Jane as many taxpayers would like to convert only her non-deductible contribution of $6,500. This would allow her to pay no taxes since she would not be converting any of the $8,540. The tax rules require use of the standard pro-rata taxation rule when an IRA has taxable funds and nontaxable funds. If she converts $6,500, a portion would be taxable and a portion would not be. The taxable portion is: $6,500 x $8,540/$15,040 ($3,690.82) and the non-taxable portion is $6,500 x $65,00/15,040 ($2,809.18) . Jane made a non-deductible IRA contribution for 2015. She is required to file Form 8606 and attach to the couple’s Form 1040. If it was not filed with the original return, an amended tax return should be filed and the 2015 Form 8606 attached. She is not relieved of this duty because she withdraws the $6,500 or converts it. A $50 penalty applies to a person who fails to file Form 8606 unless she could show a reasonable cause why she did not file it. A person must pay a $100 penalty if a person overstates the amount of non-deductible contributions. Note that Jane will also be required to file a 2016 Form 8606 regardless if she withdraws a portion or all of the $6,500.

Having to include in income the amount of $8,540 and pay tax on this amount should not influence Jane or any other wealthy person to not make non-deductible contributions. But it does. Tax on $8,540 should not be that material to a couple who are ineligible to make annual Roth IRA contributions. From a practical standpoint, Jane could convert her traditional IRA over a 2-4 year time period to lessen the amount of income which would be taxed each year.

The best of all “planning” situations would be if Jane would either work for an employer that had a 401(k) plan written to accept rollovers from traditional IRAs or if she could work for the bank and become eligible under the bank’s 401(k) plan. Why? If Jane was a participant of a 401(k) plan, the tax rules have been so written that if she would rollover a portion of the $15,040, the amount rolled over “first” is the taxable portion. The prorate rule does not apply in this situation. If Jane only rolls over $8,540, this means that the $6,500 remaining in the IRA are non-taxable. She may then convert such amount to a Roth IRA. This is her goal, this any person’s goal.

Jane wants to make as many non-deductible IRA contributions (currently $6,500 but his amount which change as it is indexed for inflation) as she can between ages 54-70½ because she should convert all such funds into a Roth IRA. What about her husband, Mark? He too wants to make the maximum amount of non-deductible IRA contributions from ages 57-70½ and at some point convert such contributions to a Roth IRA. The sooner the conversion can be completed the better as the earnings realized after the conversion will be tax free if the qualified distribution rules are met.

Most likely Mark participates in a 40(k) plan which will allow him to move ‘taxable IRA money into his 401(k) account. If not, he probably has the ability to rewrite the plan so he would have this right. The 401(k) plan in which he participates may allow him to make Designated Roth deferrals and he exercises that right to the maximum. This would be $24,000 for 2016 ($18,000 + $6,000). Good for him. But why not contribute an additional $6,500 to his traditional IRA and convert it? Contributing $6500 for 13 or 14 years would result in an additional $84,500 or $91,000 in a Roth IRA. Those individuals attaining age 70 between July and December 31st are eligible to make a contribution for their "70" year whereas those who attain age 70 and 70½ are ineligible.

Be aware that under existing laws Roth IRA funds are ineligible to be rolled over into a 401(k) plan. This is true even for 401(k) plans having Designated Roth features.

Mark too should want to make as many non-deductible traditional IRA contributions as he is eligible for until his 70½ year.

In summary, a bank president and his/her spouse want to make as many non-deductible traditional IRA contributions as possible prior to his/her 70½ year. With some pre-planning, it will be possible to convert these to be Roth IRA conversion contributions.

Edited on: Tuesday, November 08, 2016 14:17.46

Categories: Pension Alerts, Traditional IRAs

Thursday, April 21, 2016

No Form 1099-R Prepared to Report IRA Funds Moving From the Decedent’s IRA to an Inherited IRA

Some mainframe software vendors just don’t understand the IRS procedures for reporting once an IRA accountholder dies. These mainframe software writers have incorrectly adopted the approach that the Form 1099-R is to be prepared when an inherited IRA is being established.

A Form 1099-R is prepared only if there is a reportable distribution. Establishing an inherited IRA involves transferring the IRA funds from the decedent’s IRA to one or more inherited IRAs. Such transfers are not to be reported on the Form 1099-R.

Preparing a Form 1099-R which is not required to be prepared is an incorrect form and will result in penalty. The penalty is now $250 (times 2) if an IRA custodian submits an incorrect Form 1099-R

It may not be the best way, but the IRS has the IRA custodian complete the Form 5498 in a special way to inform the IRS that the decedent’s IRA funds have moved to an inherited IRA for one or more beneficiaries. Using the title, “John Doe as beneficiary of Jane Doe,” informs the IRS that funds have been moved from Jane Doe’s IRA into a inherited IRA for John Doe. The Form 1099-R is not used for this purpose.

The software vendor is causing real problems for the individual if it prepares an incorrect Form 1099-R as he or she must explain the distribution on his or her tax return. A non-spouse beneficiary is unable to rollover a distribution from an inherited IRA Putting a 0.00 in box 2a does not make things better.

Monday, July 21, 2014

Charging a Fee For a Direct Rollover of IRA Funds to a 401(k) Plan

A financial institution should consider instituting a fee if it agrees to directly rollover a customer’s IRA funds to his or her account within an employer’s 401(k) or 403(b) as discussed in the following email situation/question. It is only logical and right that a financial institution receive a reasonable fee for helping a customer when it agrees to issue a check directly to the 401(k) plan. You are helping your customer and also the 401(k) plan.

Technically, a direct rollover cannot occur between an IRA and a 401(k) plan as the law defines a direct rollover as only being between an employer sponsored plan and an IRA. But the IRS has adopted the rule that the reporting rules applying to a direct rollover from a 401(k) plan to an IRA are also to be used if the funds move from an IRA to a 401(k) plan.

The email question/situation:

Question regarding an IRA rollover from our bank to the customer’s 403b retirement plan. Assume the best is to issue a check directly to the customer and code the 1099-R as a G code? The customer will have to sign an IRA distribution form?

Please let me know if this is correct?, I have not had a request like this before, it is usually the reverse from a retirement plan into an IRA at the bank. Thanks so much for your help!

CWF’s answer/response:

The easiest approach for the bank is to issue the check to her and you would use code 1 if she is under age 59½ and 7 if she is over age 59½. You treat it as a normal distribution. Then she makes a rollover contribution to the plan.

The tax code does not require an IRA custodian to issue the check to the plan. However, many plans require the check to come from the IRA issued to the plan since this simplifies the plan administrator’s administrative concerns regarding accepting a rollover contribution.

If your institution decides to be nice and accommodate your customer, you will issue the check to ABC 401(k) Plan fbo Jane Doe. Use CWF’s Form 69 or a similar form as prepared by the plan administrator. And then you would use the reason code G in box 7 of the Form 1099-R. When G is used box 2, taxable amount, is to be completed with 0.00 as you know the amount the is non-taxable as you sent the funds directly to the plan. As you indicated it is the reverse of a direct rollover coming from a pension plan to an IRA.

An IRA custodian may have a fee for this special service as long as it has been disclosed. Like with transfer fees, we expect many customers would be willing to pay a fee for this special service.

No Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account

Those who work in the legal profession like to think the law is primarily logical and efficient. After all we are a nation of laws rather than individuals. We tend to forget that laws are enacted by politicians with input from their constituents. Many times there are self-serving motives. And sometimes judges do not like the laws which they must interpret and enforce or at least they see flaws needing to be corrected. Rather than have the legislature correct such flaws, sometimes courts choose to correct such flaws by a court ruling.

In 2005, the federal bankruptcy laws were changed. One major change dealt with credit card debt. It is now much harder to eliminate credit card debt by a bankruptcy filing. A second major change dealt with increasing the amount of funds in retirement plans and IRAs that a person could exempt from his or her bankruptcy estate. In general, the limit for IRAs is now $1,000,000 and the amount for funds in an employer sponsored pension plan is unlimited.

The public policy of the bankruptcy laws is that a person should be able to provide for himself or herself during their retirement years. However, the granting of such a large exemption for IRAs and pension plans means that many times creditors are left unpaid when an individual files for bankruptcy. Some people, including many judges, would consider such a large exemption amount to be contrary to the legal framework for bankruptcy. Yes, a person should be able to have a fresh start after incurring financial difficulties, but creditors are still entitled to be paid a reasonable and fair amount and that an individual should not have a “free pass” to an unfettered new and improved financial health.

The U.S. Supreme Court recently decided the case, Clark v. Rameker. Ms. Clark had inherited an IRA from her mother with an original balance of approximately $450,000 in 2001. The amount in her inherited IRA was approximately $300,000 when she filed for bankruptcy in October of 2010. Rameker is the bankruptcy trustee and has argued that Ms. Clark is not entitled to exempt the $300,000 from her bankruptcy estate. The bankruptcy court adopted the trustee’s position that Ms. Clark was not entitled to the exemption. Ms. Clark then appealed to the District Court. The District Court reversed the decision by ruling that Ms. Clark was entitled to exempt the amount in her inherited IRA. The trustee then appealed to the 7th Circuit Court of Appeals that which reversed the District Court. Since there had been split decisions in the circuit courts, the Supreme Court agreed to rule on the case to settle the issue.

The U.S. Supreme Court affirms the 7th Circuit position of no exemption for inherited IRA funds.

The legal analysis and rationale. The U.S. Supreme Court ruled, by a unanimous vote, that “The text and purpose of the Bankruptcy Code makes clear that funds held in inherited IRAs are not retirement funds within the meaning of section 522(b)(3)(C) is bankruptcy exemption.” Justice Sotomayer wrote the court’s opinion.

As discussed below, the U.S. Supreme Court had to strain the law to reach the result that allowed the bankruptcy trustee to win and Ms. Clark to lose.

How does Bankruptcy Code section 522(b)(3)(C) read ?

Bankruptcy code section 522(b)(3)(C) provides an exemption for “(C) retirement funds to the extent that those funds are in a fund or account that is exempt from taxation under section 401, 403, 408, 408A, 414, 457, or 501(a) of the Internal Revenue Code of 1986.” Code section 401 defines the laws for a qualified plan. Code section 403 defines the laws for tax sheltered annuities. Code section 408 defines the laws for traditional IRA and IRA annuities. Code section 408A defines the laws for Roth IRAs and Roth IRA annuities.No Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account

Note that there is no special tax code section for inherited IRAs. An inherited IRA is not a special type of IRA as the court tries to define it. An inherited traditional IRA is simply one that comes into existence after the IRA accountholder dies.

Also note that there is no express indication that the retirement funds must be the retirement funds of the bankruptcy debtor. This is what one expects when one has funds in a 401(k) plan or an IRA. These funds are within a legal and tax entity independent of the individual’s will or estate. There is a 401(k) plan agreement or an IRA plan agreement which requires the individual to designate one or more primary beneficiaries. Such plan indicates that the beneficiary acquires his or her share upon the death of the participant or IRA accountholder.

Notwithstanding that the account is called an inherited individual RETIREMENT account, the U.S. Supreme Court on June 2, 2014, ruled that funds within an inherited IRA are not retirement funds within the meaning of Bankruptcy Code section 522(b)(3)(C).

Federal bankruptcy laws allow an individual to exempt certain property from his or her bankruptcy estate. This is property he or she is allowed to keep after the bankruptcy and that cannot be claimed by the bankruptcy trustee. The approach of the bankruptcy laws is to give a person the ability to have a fresh start after incurring financial difficulties. Of course, there should be and there are limits as to the ability of a person not to pay his or her debts.

The attorney for the bankruptcy debtor argued that Bankruptcy code section 522(b)(3)(C) was clear – funds within any traditional IRA, including an inherited traditional IRA, as established under Code section 408 were entitled to the exemption. The District Court in this case, the Fifth Circuit in a different case and the Eighth Circuit in a different case had the same understanding. The rationale of the District Court was that the exemption covers any account containing funds originally accumulated for retirement purposes. This is consistent with the legal operation of a traditional IRA. It is a special tax-preferred revocable trust. It has two express purposes. Contributions and the investments will be used for the retirement of the IRA accountholder and then after his or her death will be used to benefit the designated beneficiary over a time period which may be as long as the life expectancy of the beneficiary.

The U.S. Supreme Court reached a different conclusion. In order to be entitled to claim the exemption of Bankruptcy Code section 522(b)(3)(C) , the court ruled that an individual has to meet two requirements, not just one requirement. First the funds must be retirement funds. Second, such funds must have been in a fund or account that is exempt from taxation under section 401, 403, 408, 408A, 414, 457, or 501(a) of the Internal Revenue Code of 1986.”

The U.S. Supreme Court wrote that the two words “retirement funds” as set forth in Bankruptcy Code section 522(b)(3)(C) mean more than just funds in the enumerated tax code sections. A cardinal rule of statutory construction is, “a statute should be construed so that effect is given to all its provisions, so that no part will be in operative or superfluous. The first six words, “retirement funds to the extent that” in order not to be superfluous must have a meaning or purpose independent of the enumerated sections.

The court then found that since there was no definition of “retirement funds” within the Bankruptcy Code that it must define the term and it did so. It defined retirement funds as sums of money set aside for the day an individual stops working.

The court then reasoned that there are three principal reasons why inherited IRA funds are not retirement funds. First, the beneficiary is unable to make any additional contributions. Second,No Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account the required distribution rules apply to an inherited IRA and distributions must be taken long before retirement age. Third, the 10% penalty tax does not apply to a beneficiary and so the beneficiary is able to take a distribution at any time and use the funds for current consumption. It is this later reason which seems to have influenced the court’s decision the most. The court stated its dislike for the possibility that a person who has an inherited IRA could file for bankruptcy, claim the exemption for retirement funds and then after the bankruptcy has been granted eliminating his or her debts immediately withdraw funds from the inherited IRA for personal consumption reasons. In essence the debtor would have a free pass which is not the intent of the Bankruptcy laws. The court was unwilling to give this free pass.

Additional Litigation

There will be additional litigation by bankruptcy trustees as a result of his case. The U.S. Supreme Court has made clear it is receptive to consider cases involving whether or not - the exemption of Code section 522(b)(3)(C) is available to a bankruptcy filing.

This case settles the issue with respect to an inherited traditional IRA.

The case of In Rousey v. Jacoway, settled that a traditional IRA was a retirement account within the meaning of Bankruptcy code section 522(b) (3) (C) and was entitled to be exempted from the individual’s bankruptcy estate.

When one reads this case, one certainly has the idea that an inherited Roth IRA would also be found to not be retirement funds for bankruptcy Code section 522(b)(3)(C) purposes.

What about standard Roth IRA funds? Although we expect that the rules of Rousey would apply to a Roth IRA and the exemption would apply, this issue has not been firmly settled. One can expect that a bankruptcy trustee will make the argument that Roth IRA funds are not retirement funds since the Roth IRA accountholder never has to take a distribution while alive.

What about inherited 401(k) funds still within the 401(k) plan? One can expect a bankruptcy trustee to argue that inherited 401(k) funds also are not retirement funds within the meaning of Bankruptcy Code section 522(b)(3)(C). ERISA protects such funds from creditors, including a bankruptcy trustee, as long as such funds are within the 401(k) or other pension plan. Many 401(k) plans have been written to require an inheriting beneficiary to withdraw or direct rollover his or her inherited funds within a short time period.

This bankruptcy ruling is going to result in more IRA accountholders seeking legal and tax advice regarding whether a trust should be the IRA’s designated beneficiary rather than directly naming family members and other individuals.

Additional Legislation.

This case is going to make people nervous. Congressional representatives will hear from their constituents that a person who has inherited an IRA should be able to exempt a reasonable amount from his or her bankruptcy estate. If the definition of retirement funds needs to be changed, then it should be changed. What amount is reasonable will need to be discussed and settled.

In summary, the unanimous decision by the U.S. Supreme Court in Clark v. Rameker was surprising. Although an inherited IRA is certainly a retirement account for tax purposes, it is notNo Bankruptcy Exemption For Funds Within an Inherited Individual Retirement Account retirement funds within the meaning of the Bankruptcy Code. Code section 522(b)(3)(C) did not seem so unclear that it needed to be rewritten by the Court, but that is what the Court did. The Court simply could not condone a bankruptcy debtor claiming an exemption for funds within an inherited IRA and then once the bankruptcy filing was finalized (and debts extinguished) to be able to take immediate distributions from the inherited IRA for any personal consumption purpose. Time will tell if Congress will choose to define more specially what funds qualify as retirement funds for purposes of the exemption. We expect there will be new legislation in 2014-2015.

What is the status of myRA ?

Presumably, the IRS on behalf of the U.S. Department of the Treasury is in the process of developing what is needed to implement and administer the myRA program. There will need to be created myRA plan agreements, investments and computer software.

In January of 2014 the U.S. Department of Treasury announced that it was developing the myRA (“My Retirement Account”) program. This was discussed in the February 2014 newsletter. You may find this article at www.pension-specialists. com/myra.pdf

The U.S. Treasury stated that it will begin rolling out the myRA forms and procedures in late 2014. This means after the November 4th elections. It will be possible for eligible employees of participating employers to enroll by signing up for a myRA account online.

It is presently unclear if an individual’s contributions would be invested in an investment created and administered by the U.S. Treasury or whether the U.S. Treasury would select various financial institutions to serve as the myRA custodian or trustee. An employer’s duties under this program would be limited to sending by direct deposit the contribution amounts withheld from employee paychecks to each employee’s on-line myRA. Once the U.S. Department of the Treasury furnishes the promised guidance, we will inform you.

Thursday, June 12, 2014

Helping A father Who Has Inherited His Daughter’s 401(k) Account

Raul, age 58, has been a bank customer since 1998. He presently does not have an IRA. He does have a 401(k) account at his employer. His daughter Laura, age 31, died March 2014, in a car accident. Laura had designated her father to be the beneficiary of her 401(k) account. The 401(k) plan administrator had contacted Raul to inform him that he was Laura's beneficiary and that her account balance was approximately $60,000. He has come into the bank seeking some help.

Raul is fairly sure that he will decide to establish an inherited IRA with your financial institution.